4 Compelling Benefits of Leasing Equipment vs Buying

Benefits of Leasing Equipment vs Buying

The decision to lease or buy equipment is a critical one that can impact your business’s bottom line. With approximately 80% of U.S. companies opting to lease some or all of the equipment they use, it’s clear that leasing has become a popular choice for business owners. Whether you’re a small business owner looking to acquire new equipment or a larger enterprise seeking to upgrade your technology, the benefits of leasing equipment vs. buying are compelling.

Leasing equipment offers numerous advantages for business owners. From the ability to avoid purchasing equipment outright to the flexibility of upgrading equipment at the end of the lease term, leasing allows you to use the latest technology without a significant upfront investment.

Additionally, lease payments are often tax deductible as a business expense, contributing to improved cash flow and reduced financial strain on your business. Overall, the decision to lease or buy equipment is one that can have lasting implications for your business, so it’s important to weigh the pros and cons carefully to determine the best option for your unique business needs.

Minimal Upfront Capital

Leasing an essential piece of business equipment offers many advantages over an outright purchase. When it comes to conserving your upfront capital, leasing can be the best option for your business. You can acquire the equipment you need without having to pay for it all at once, leaving your capital free for other critical needs and initiatives. This allows you to use the equipment to grow your business while making manageable monthly payments.

Leasing companies offer flexible terms that can be tailored to fit your specific business needs and the type of equipment you require. This means you can use the equipment without owning it outright, avoiding the significant cash outlay that comes with a direct purchase. Additionally, with a lease agreement, you may have the option to upgrade to newer equipment when needed, avoiding the headache of dealing with outdated or obsolete equipment.

Another important benefit of leasing over purchasing is the potential tax benefits. Leasing business equipment may allow you to deduct the monthly payments as business expenses on your tax returns, providing a valuable financial advantage. Additionally, leasing allows you to avoid the risk of being stuck with equipment that you can’t return or sell, as you might with a direct purchase.

Considering the cost of leasing and the advantages it offers, it’s important to weigh the pros and cons of leasing versus buying to make the best decision for your business. While buying has its own set of advantages, leasing can provide the flexibility and financial benefits that make it a better option for many businesses.

Protection Against Obsolete Equipment

As a 1800 Office Solutions Experts, it’s essential to consider the impact of outdated equipment on your business operations. Picture this: you’re in the middle of a critical client meeting, and your office equipment suddenly malfunctions, leaving you scrambling to find a quick solution. The frustration and potential loss of credibility in that moment can be avoided by making strategic decisions about your equipment.

When it comes to equipping your business with the tools it needs to thrive, it’s important to weigh the advantages of ownership against the disadvantages of buying. Purchasing business equipment may seem like a straightforward decision, but it’s crucial to consider the long-term implications. A piece of equipment that has a long and productive life can be a valuable asset, but what about those pieces that quickly become obsolete?

Leasing equipment offers the flexibility to upgrade equipment as technology evolves, mitigating the risk of being stuck with outdated equipment. On the other hand, buying equipment outright means you have the freedom to customize and modify the equipment to suit your specific business needs. The decision to buy or lease equipment depends on the specific requirements of your business and the cost of equipment financing. Additionally, leasing can provide the opportunity to acquire equipment without tying up your cash flow, making it an attractive option for many businesses.

Ultimately, the choice between leasing and buying equipment comes down to assessing the life of the equipment and making a decision that aligns with your business goals. It’s about finding the balance between staying ahead of the curve with the latest technology and making sound financial decisions for your business.

Flexible Terms and Options

When it comes to acquiring equipment for your business, you may find yourself torn between whether to purchase the equipment outright or explore the option of leasing. Understanding the difference between buying and leasing can help you make a well-informed decision that aligns with your business goals and financial situation.

One of the key advantages of leasing is the ability to upgrade equipment without the burden of owning outdated or obsolete equipment. This flexibility allows you to stay ahead of technological advancements and maintain a competitive edge in your industry. On the other hand, purchasing equipment outright may provide the benefits of ownership, but it also comes with the risk of being stuck with old equipment that has a long lifespan.

Moreover, leasing offers you the advantage of avoiding the hassle of selling existing equipment when it’s time for an upgrade. This can save you time and effort, which can be better utilized to run your business. Conversely, buying equipment outright means you are responsible for selling or disposing of the old equipment when it’s time to upgrade, adding an extra layer of complexity to the process.

As a 1800 Office Solutions expert, I understand the importance of having the right equipment for your business operations. Whether to lease or buy equipment is a decision that requires careful consideration of the advantages and disadvantages of each option. By weighing the pros and cons of leasing versus buying, you can determine the best option for your business and make the decision that aligns with your long-term goals.

Fixed Monthly or Quarterly Payments

When it comes to deciding whether to purchase equipment or opt for an equipment lease, the emotional rollercoaster of uncertainty can be overwhelming. The fear of making the wrong decision can paralyze any business owner. But fear not, as there is a clear and reliable path to follow.

First and foremost, leasing may provide you with the flexibility needed to stay ahead of the curve. Choosing to lease equipment allows you to avoid the hassle of dealing with outdated equipment. Instead, you can simply return the equipment at the end of the lease and upgrade to the latest and greatest without missing a beat.

Furthermore, leasing can also be a saving grace when it comes to managing the cost of equipment. Rather than tying up your hard-earned cash to purchase equipment outright, you can secure the equipment with cash that can be used for other critical aspects of your business. Not to mention, leasing provides a predictable expense, making it easier to manage your business expenses on your tax.

Lastly, a major advantage of opting for an equipment lease is the ability to sell existing equipment without the hassle of finding a buyer. This can save you time and effort, allowing you to focus on running your business instead of trying to offload old equipment.

In conclusion, the decision to buy or lease equipment is not just about the financial aspect, but also about the freedom, flexibility, and peace of mind that leasing can provide.

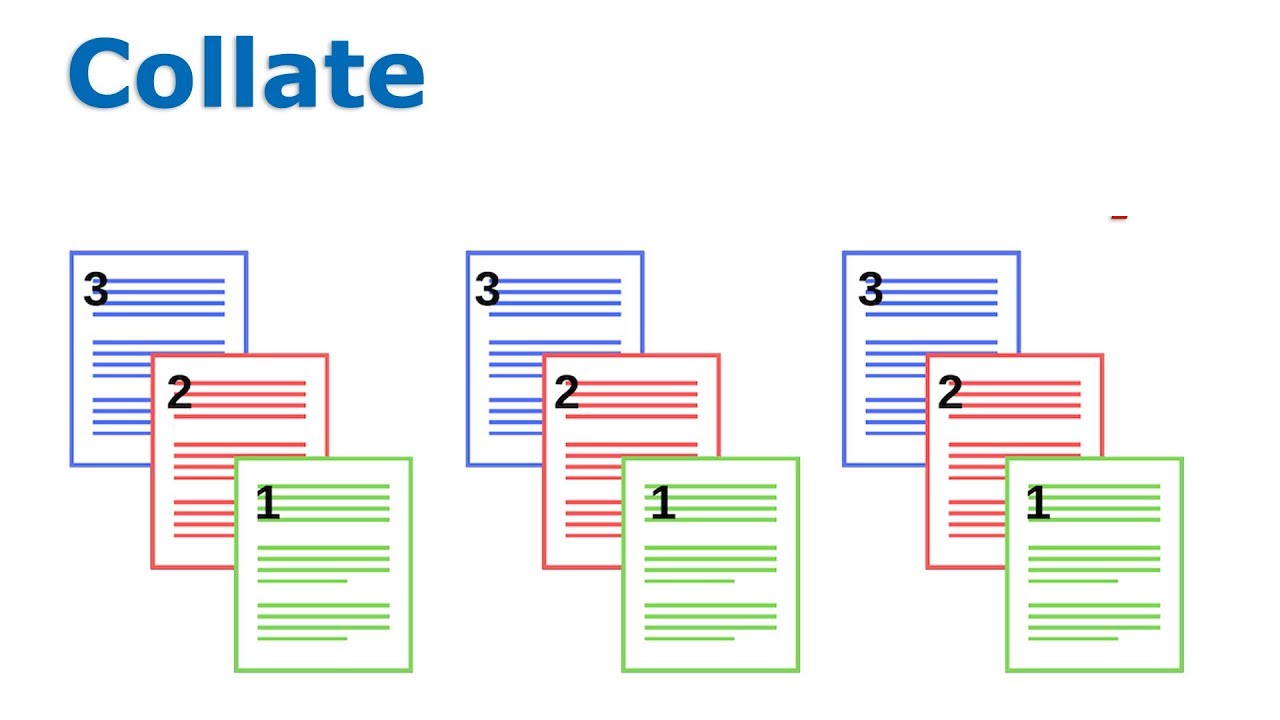

Is leasing better than buying a copy machine?

Whether leasing or buying a copy machine is better depends on your specific business needs and financial situation. Here are some key points to consider:

- Initial Cost and Budgeting: Buying a copier requires a significant upfront investment, which might be a hurdle for small businesses or startups. Leasing, on the other hand, involves smaller, regular payments, making it more manageable for businesses with limited capital or those who prefer to maintain cash flow for other investments.

- Maintenance and Repairs: Leasing agreements often include maintenance and repair services, reducing the burden on your business to handle these issues. When you own a machine, these costs and the responsibility for repairs fall on you, which can be expensive and time-consuming.

- Technology Upgrades: Technology evolves rapidly, and leasing allows businesses to upgrade to newer models at the end of a lease term. This can be crucial for businesses that rely on having the latest technology. Buying a machine means you’re stuck with it until you decide to invest in a new one.

- Tax Implications: Lease payments can often be deducted as a business expense, potentially offering tax benefits. Purchasing a machine is a capital expenditure, with different tax implications, such as depreciation.

- Long-Term Costs: While leasing can be more expensive in the long run, it offers flexibility and predictability in expenses. Buying a machine may be more cost-effective over time, but it requires a larger initial investment and the costs can be unpredictable, especially if the machine requires repairs or becomes obsolete.

Conclusion

In conclusion, when it comes to leasing equipment versus buying, the compelling benefits of minimal upfront capital, protection against obsolete equipment, and flexible terms and options make a strong case for the advantages of leasing. With fixed monthly or quarterly payments, business owners can plan and budget more effectively, knowing exactly what their equipment expenses will be. This allows for better financial management and cash flow, without the burden of a large, upfront equipment purchase.

Leasing equipment also provides the peace of mind that comes with not being stuck with outdated technology. The ability to upgrade or stop using the equipment without the financial burden of ownership is a significant advantage. Additionally, the flexibility of leasing, much like leasing a copy machine, copier or printer, allows for the acquisition of equipment without owning it, enabling businesses to stay current with the latest technology and industry advancements. Ultimately, considering the cons of buying, such as the potential for equipment to become obsolete, it becomes clear that leasing equipment can be the better option for many businesses.