Buyout Option in Copy Machine Lease: The Unexpected Advantage You Might Be Missing

Introduction

In business, the term copier lease buyout often comes into play, especially when considering the optimization of resources and cost-saving strategies. A copier lease buyout refers to the process where a business opts to buy the copier they have been leasing, usually towards the end of your lease term.

This option can provide an unexpected advantage by allowing a company to retain a piece of equipment that has proven to be valuable to its operations.

The importance of understanding copier lease buyouts lies in the potential financial benefits and the flexibility it offers in managing current printer or copier needs. In this blog post you’ll learn the buyout options in your copy machine lease and how you get advantages from it.

Difference Between Copier Lease and Service Agreement

Copier Lease: Definition, binding nature, and purpose

- Definition: A copier lease is a contractual agreement between a business and a lease company, allowing the business to use a copier for a specified period.

- Binding Nature: The lease is legally binding, committing both parties to the terms for the duration of the lease.

- Purpose: Leasing a copier enables businesses to access new equipment without the upfront cost of purchasing. It aligns with the need for a current copier lease without the financial burden.

Copier Service Agreement: Definition, flexibility, and purpose

- Definition: A copier service agreement is a separate contract that covers maintenance and support for the leased copier.

- Flexibility: Unlike the copier lease, this agreement can often be more flexible, allowing for changes in service levels or providers.

- Purpose: Ensures that the copier remains in optimal condition, providing consistent quality and performance.

Comparison between the two

- While both agreements are essential in the context of leasing a copier, they serve different functions. The copier lease binds the business to the use of the copier, while the service agreement ensures its maintenance. Understanding the difference is vital when considering a buyout, as the buyout typically applies to the lease, not the service agreement.

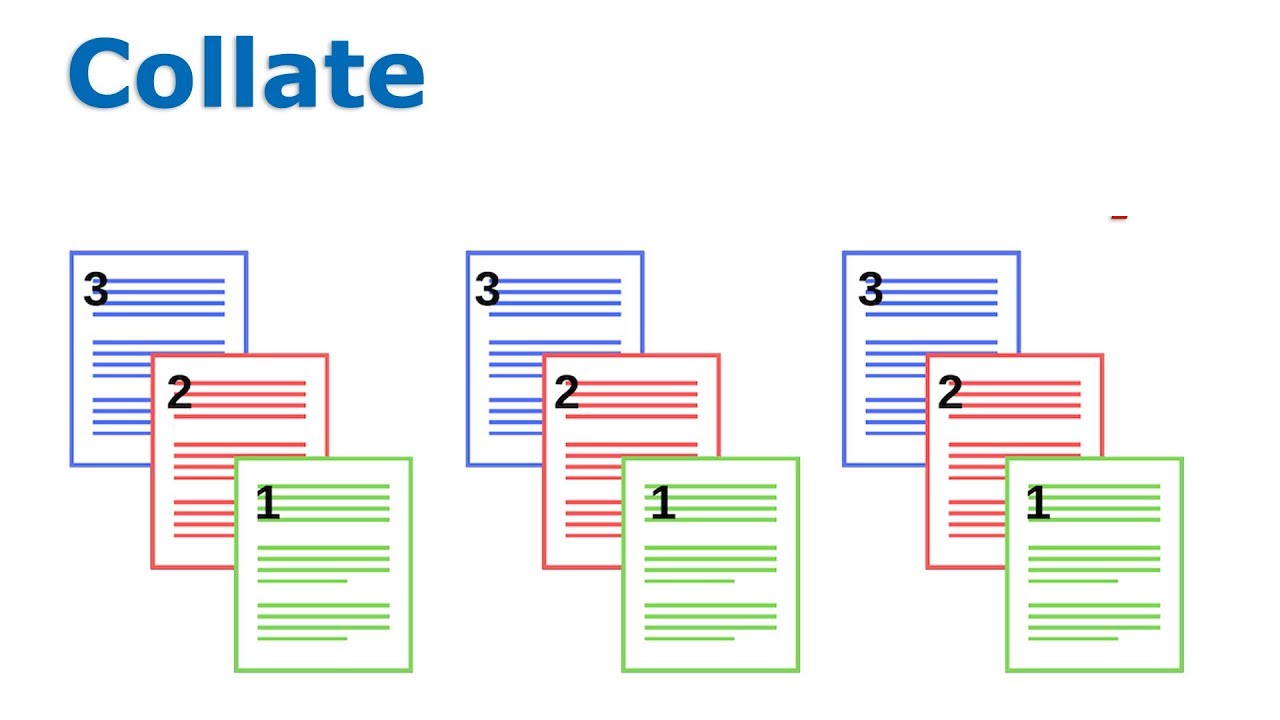

How Copier Lease Buyouts Option Work

The process of buying out a copier lease

- Understanding the Option: Most copier leases include a buyout option, allowing the lessee to purchase the copier at the end of the lease term.

- Evaluating the Costs: The buyout price is usually defined in the lease agreement and may be influenced by the copier’s age, condition, and existing lease terms.

- Making the Decision: The decision to buy out the lease should be based on a thorough analysis of the copier’s ongoing value to the business, considering factors like new equipment needs and termination costs.

Misleading nature of the term “buyout”

- Not Always a Bargain: The term “buyout” may imply a bargain purchase, but that’s not always the case. The buyout price may be higher than the market value of the copier.

- Understanding Terms: It’s crucial to understand the terms of the buyout, including any additional fees or conditions. Misunderstanding these can lead to unexpected costs.

How dealers afford to buyout copiers

- Dealer’s Perspective: Dealers offer buyouts as a way to retain customers and potentially sell new copiers. The buyout price is often calculated to cover the dealer’s costs and generate a profit.

- Win-Win Situation: If done right, a buyout can be a win-win, allowing the business to retain a valuable asset and the dealer to maintain a customer relationship.

Understanding the intricacies of copier lease buyouts, including the difference between a copier lease and service agreement, can provide businesses with unexpected advantages. Whether it’s retaining a valuable piece of equipment or negotiating favorable terms with a dealer, a buyout option can be a strategic move in managing business resources.

Advantages and Process Copier Lease Buyout Option

Advantages of Copier Lease Buyout Option

Flexibility to switch providers

- Flexibility: A copier lease buyout allows businesses to switch providers if they are unhappy with their current service provider. This flexibility can lead to better equipment or more favorable terms with a new leasing company.

- New Opportunities: By buying out the lease, a company can explore new service providers without being tied to the old lease. This can lead to a more aligned office technology strategy.

Cost-saving potential

- Immediate Savings: By buying out a lease that no longer serves the company’s needs, immediate cost savings can be realized. The buyout work can reduce monthly payments, especially if the current lease rate is above market value.

- Long-term Benefits: Over the lease period, these savings can accumulate, making the buyout a feasible option that makes the most sense financially.

Alignment with company goals and values

- Strategic Alignment: A copier lease buyout can align with company goals, such as upgrading to a newer model or choosing to purchase the equipment outright.

- Value Alignment: If you’re happy with your current copier, a buyout can reinforce the company’s commitment to sustainability and cost efficiency.

Process of Copier Lease Buyout Option

Reviewing the condition for cancellation

- Understanding Terms: Review the copier lease agreement to understand the conditions for cancellation. Look for clauses that might affect the buyout option, such as early termination fees or fair market value leases.

- Legal Consultation: It may be wise to consult with legal experts to ensure that the buyout complies with all lease requirements.

Paying off the lease amount

- Calculation: Determine the remaining payments and the buyout price. Consider the fair market value and any other factors outlined in the lease.

- Payment: Arrange for the payment, whether it’s a lump sum or structured payments. Ensure that the payment aligns with the end date of the lease.

Checking for assumption clauses

- Assumption Clauses: These clauses may allow another company to assume the lease. Understanding these can provide additional options, like bringing in a new service provider.

- Legal Compliance: Ensure that any assumptions comply with the lease terms and legal requirements.

Lease transfer (copier lease buyout option)

In a typical copier lease buyout, the lessee may decide to purchase the copier outright before the lease term ends or transfer the lease to another party. This can be motivated by various factors such as technological advancements, changes in business needs, or financial considerations.

The process usually involves a detailed assessment of the existing lease agreement, including the remaining term, monthly payments, and any early termination fees. The lessee may negotiate with the leasing company or work with a third party specializing in lease buyouts to find the best solution.

Lease transfers can provide flexibility but also come with complexities and potential risks. It’s essential to understand the terms and conditions of the original lease, as well as the legal and financial implications of the transfer. Professional guidance from legal and financial experts is often recommended to ensure a smooth and beneficial transition.

- Transfer Process: If you’re trading one lease for another, understand the process and ensure that the new leasing company bundles the new lease properly.

- New Lease Alignment: Ensure that the new lease aligns with the company’s needs and offers better lease terms.

Negotiating with the provider for early termination

- Negotiation Strategy: Develop a strategy for negotiating early termination if it aligns with the company’s goals. This might include leveraging the option to purchase or demonstrating how the current equipment doesn’t meet your business needs.

- Successful Negotiation: A successful negotiation can lead to cost savings and a smoother transition to the next lease.

When to Consider a Copier Lease Buyout

Maintenance pricing considerations

- Maintenance Costs: Consider the copier service agreement and whether the maintenance costs are prohibitive. A buyout might allow for a new service provider and better pricing.

- Equipment Age: If the copier you leased a few years ago is still meeting your business needs, a buyout might be more economical than leasing a new one.

Business upgrading needs

- Technology Upgrades: If better equipment is available, a buyout might facilitate an upgrade.

- Alignment with Goals: Ensure that the upgrade aligns with business goals and is not merely a reaction to lease expiration.

Competitor pricing

- Market Analysis: Compare the lease payment with competitor pricing. If the monthly lease payment is higher, a buyout might be a wise financial decision.

- Negotiation Leverage: Use competitor pricing as leverage in negotiating a buyout lease.

Unfair agreement realization

- Reevaluation: If the copier lease that no longer serves the company’s needs is discovered to be unfair, a buyout might be the best course of action.

- Legal Considerations: Consult with legal experts to ensure that the buyout is conducted legally and ethically.

Automatic renewal considerations

- Automatic Renewal Clauses: Understand the implications of automatic renewal and how it might affect the decision to buyout the lease.

- Strategic Planning: Plan the buyout to avoid automatic renewal if it’s not in the company’s best interest.

What People Also Ask

What is a copier lease buyout?

A copier lease buyout is the process where a lessee chooses to purchase the copier equipment at the end of the lease term. It allows the lessee to own the equipment rather than returning it to the lease provider.

How does a copier lease buyout work?

A copier lease buyout works by paying the remaining payments and any additional buyout costs as defined in the lease agreement. It may require negotiation with the lease provider and adherence to specific lease terms.

What are the benefits of a copier lease buyout?

The benefits of a copier lease buyout include cost savings, flexibility to switch providers, alignment with company values, and the ability to retain equipment that is still functional and valuable to the business.

When should a business consider a copier lease buyout?

A business should consider a copier lease buyout when it aligns with strategic goals, offers cost savings, allows for upgrades or changes in providers, or when the current lease is found to be unfair or no longer serves the company's needs.

How to negotiate a copier lease buyout?

Negotiating a copier lease buyout requires understanding the lease terms, evaluating the fair market value, and communicating effectively with the lease provider. It may also involve legal consultation and strategic planning.

Conclusion

In summary, a copier lease buyout offers a strategic advantage for businesses looking to optimize their office systems. From cost savings to alignment with company values, the buyout option provides flexibility and control over office equipment.

Understanding the process, from reviewing cancellation conditions to negotiating with providers, is essential to truly getting “out” of a lease in a way that benefits the business.

Whether it’s retaining a leased copier that still meets needs or cutting a check for a buyout to bring in new technology, the decision should be well-informed and aligned with business goals. The insights provided here encourage businesses to consider copier lease buyouts as a viable and often advantageous option in managing resources and technology.