The Hidden Costs of Rental Copy Machine: What Vendors Aren’t Telling You!

Rental Copy Machine

From the moment the revolutionary Xerox 914 was introduced in 1959, the modern workplace was forever changed. The copier became an emblem of efficiency, transforming the way businesses operated. Over the decades, as technology evolved, so did the humble copier, morphing into the multifunctional machines we see today. These devices, now capable of printing, scanning, and copying, are essential in almost every office. However, an ongoing debate has persisted: Should businesses buy or lease these machines? In this blog post you’ll know about rental copy machine process and hidden costs.

The decision to rent or purchase office equipment, especially a printer or copier, is not straightforward. It’s influenced by several factors, including the company’s financial situation, its printing needs, and the desired equipment’s functionality.

Copy Machine Leasing

Copier leasing is a financial arrangement that allows businesses and individuals to obtain a copier machine without the need to pay the full upfront cost. Instead of purchasing the copier outright, lessees agree to make regular payments over a specified period, after which they can choose to buy the machine, renew the lease, or return the equipment. This arrangement provides flexibility and can be a cost-effective solution for many, especially those who need advanced equipment without the hefty initial investment.

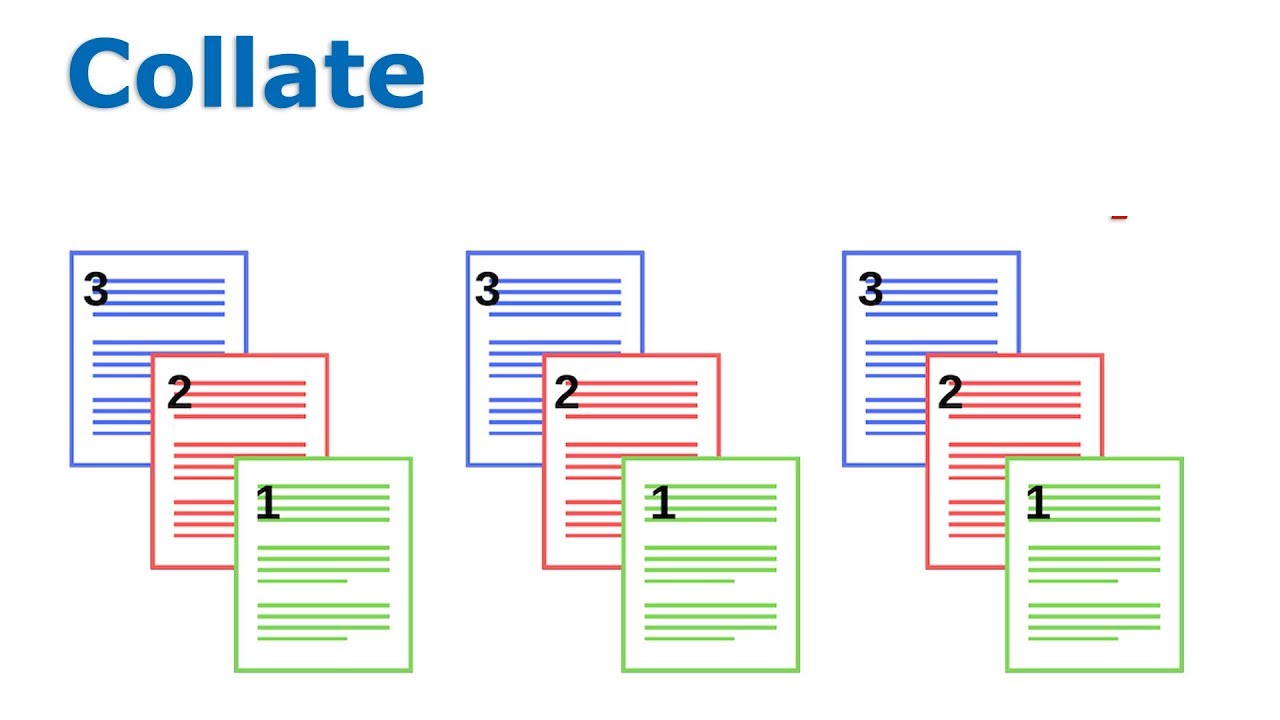

How Copier Leasing Works

When you lease a copier, you enter into a contract with a leasing company. This contract outlines the terms of the lease, including the duration (often ranging from 12 to 60 months), monthly payment amounts, and any additional terms or conditions. At the end of the lease term, you typically have the option to purchase the copier, continue leasing, or return the machine.

Benefits of Copier Leasing

- Flexibility: Leasing allows businesses to upgrade to newer models easily, ensuring they always have access to the latest technology.

- Budget-Friendly: Monthly lease payments can be more manageable than the large upfront cost of purchasing a copier outright.

- Tax Advantages: Lease payments can often be written off as a business expense, potentially offering tax benefits.

Considerations Before Leasing

- Total Cost: Over the long term, leasing might end up being more expensive than purchasing, especially if the lease is continually renewed.

- Contractual Obligations: Leases come with binding agreements, and breaking them can lead to penalties.

- Maintenance and Repairs: Some leases include maintenance, while others might charge extra for this service.

Copier leasing is an attractive option for many businesses, offering the chance to use high-quality equipment without the significant initial expense. However, like any financial decision, it’s essential to weigh the pros and cons and ensure the terms align with your business needs and financial situation.

Comparing Buying vs Rental or Lease Costs

Costs of Buying a Printer/Copier:

- The price range for a printer and copier can vary significantly. From basic models to industry-leading multifunction printers, costs can range from a few hundred to several thousand dollars.

- Factors affecting the price include the machine’s functionality, printing capacity (measured in pages per minute or PPM), and its intended purpose. For instance, a multi-function printer designed for a large corporation will undoubtedly cost more than a basic rental copy machine rental for short-term use.

- Brands like Canon, Konica Minolta, and Kyocera offer a variety of models catering to different business needs.

Costs of Leasing a Printer/Copier:

- Leasing a copier or printer often comes with monthly rates. These rates can be influenced by the machine’s capabilities, the lease’s duration, and any additional services included, like repair or technical support.

- Printer leasing can be a viable option for businesses that need top-tier equipment but are hesitant about the upfront investment. With options like month-to-month leases or longer-term contracts, businesses can find the right balance between cost and convenience.

- It’s essential to consider the total cost over the lease term. While the monthly expense might seem manageable, the cumulative amount over several years can be substantial.

Pros of Leasing a Copier

Leasing office equipment, especially a multifunction printer, has its advantages:

Lower Out-Of-Pocket Expenses:

One of the primary benefits of leasing a copier is the reduced initial cost. Instead of a significant upfront investment, businesses can manage their finances better with predictable monthly payments.

Flexible Commitment:

Copier rental companies often offer flexibility in their lease terms. Whether you’re a startup needing a short-term solution or an established business looking for a long-term partnership, there’s likely a plan to meet your needs. Call us today to explore the best options for your business.

Tax Benefits:

Leasing can also provide tax advantages. Monthly lease payments can often be written off as business expenses, potentially reducing a company’s taxable income.

Cons of Leasing a Copier

While leasing might seem like the perfect solution, it’s essential to be aware of the potential drawbacks:

Additional Costs:

Beyond the monthly lease payments, there might be hidden costs. These can include charges for additional services, consumables, or even interest on the lease amount.

Locked Lease Periods:

Leases are binding agreements. Once you’ve signed, you’re committed to the terms, whether they span a year or several years. It’s crucial to understand the lease’s duration and any penalties for early termination.

No Immediate Ownership:

At the end of the lease term, the copier and printer remain the property of the leasing company. Some companies might offer a buyout option, but in many cases, the equipment must be returned.

Pros of Buying a Copier

- Immediate Ownership: When you buy a copier, you have immediate ownership of the equipment. This means you have full control over its usage, maintenance, and any modifications you might want to make.

- May Be Cheaper In The Long Run: While the initial investment might be high, in the long run, owning a copier might prove to be cheaper. Especially when considering copier lease terms and the potential costs associated with month-to-month or short-term leasing agreements.

- Additional Equity: Owning a multifunction printer or copier adds to the equity of your business assets. Brands like Canon and Xerox are known for their durability and can serve as valuable assets for years.

Cons of Buying a Copier

- Higher Upfront Cost: The initial investment for a printer and copier can be substantial. Especially if you’re looking for a high-end multi-function copier with advanced functionality.

- Challenging Upgrades: Technology evolves rapidly. Owning a copier means you might be stuck with outdated technology after a few years, making upgrades challenging and potentially costly.

- More Responsibility: With ownership comes responsibility. This includes regular maintenance, repair, and ensuring the copier meets your business needs. Unlike a rental copy machine rental, where the responsibility often lies with the leasing company.

Making the Decision: Should You Buy or Lease?

When it comes to deciding between buying or leasing a copier, it’s essential to weigh the pros and cons. Leasing offers the convenience of having the latest equipment without the responsibility of ownership. Many businesses appreciate the peace of mind that comes with leasing, especially when it includes managed print solutions.

On the other hand, buying might be a more comprehensive investment in the long run, especially if you’re a business that requires consistent use of a printer or copier. Whether you’re looking for a short-term solution or a long-term investment, it’s crucial to find the right option that meets your business needs.

What People Also Ask

What are the hidden costs associated with copier leases?

While leasing a copier might seem cost-effective initially, there are often hidden costs. These can include fees for exceeding the agreed-upon pages per minute (ppm), charges for color multi-function prints, and costs associated with ending a lease early.

How do brands like Canon and HP compare in terms of copier leasing?

Brands like Canon and HP are industry-leading when it comes to office equipment. Canon’s multifunction printers are known for their reliability and advanced features, while HP offers flexible lease terms and robust technical support.

Is it possible to get a short-term rental for a copier?

Yes, many companies offer short-term rentals for copiers, especially for events or short-term projects. This can be a cost-effective solution if you need a copier for a limited period.

How does a multifunction printer differ from a regular printer?

A multifunction printer, often referred to as a multi-function copier, combines the functionality of a printer, scanner, copier, and sometimes a fax machine. This all-in-one solution is ideal for businesses looking to save space and improve productivity.

Conclusion

In the ever-evolving landscape of business operations, the decision to buy or lease office equipment, particularly copiers, remains a pivotal one. Both options come with their unique sets of advantages and challenges. While purchasing a multifunction printer or copier offers the allure of immediate ownership and long-term cost savings, leasing presents a flexible, often more manageable upfront financial commitment, especially for businesses that prioritize staying updated with the latest technology. It’s essential to recognize that there’s no one-size-fits-all answer.

The best choice hinges on a company’s financial standing, operational needs, and future growth projections. As technology continues to advance at a breakneck pace, businesses must remain agile, making informed decisions that bolster productivity and fiscal health. Whether you’re a startup looking for short-term solutions or an established enterprise aiming for a comprehensive investment, understanding the intricacies of buying versus leasing is paramount.

In the end, it’s not just about having a piece of equipment; it’s about ensuring that every investment, be it time, money, or resources, aligns seamlessly with your business’s overarching goals and vision.