5 Things to Check Before You Sign a Copier Lease Agreement

AI Overview:

This blog gives businesses a clear, simple breakdown of copier lease agreements—how they work, what they cost, and how to avoid common traps. It explains key lease types (FMV vs. $1 Buyout), how term length affects monthly payments, what should be included in your service agreement, and how CPC pricing impacts your budget. Readers also learn about hidden fees, automatic renewal clauses, and the differences between leasing, renting, and purchasing.

The article then walks through end-of-lease options—returning, upgrading, or buying—and highlights essential steps like data wiping and shipping costs. Overall, it equips business owners with the knowledge to negotiate fair terms and choose a lease that truly fits their needs.

Why Understanding Copier Lease Agreements Matters

Copier lease agreements are complex contracts that can significantly impact your office technology budget. With nearly 85% of commercial copiers being leased, understanding these agreements is crucial for avoiding costly mistakes and securing a fair deal.

Key Components of Copier Lease Agreements:

- Lease Type: Fair Market Value (FMV) or $1.00 Buyout

- Term Length: Typically 36-60 months

- Monthly Payments: Depending on equipment

- Service Coverage: Maintenance, toner, and repair inclusions

- End-of-Lease Options: Return, purchase, or upgrade

Many businesses rush the signing process, overlooking critical details like automatic renewal clauses or hidden fees.

The stakes are high, as copier leases are typically non-cancellable agreements with absolute payment obligations. But with the right knowledge, you can choose a lease that supports your business goals without breaking your budget.

Similar topics to Copier lease agreements:

- Affordable copier leasing

- Thousand Oaks Copier Lease

1. Check the Lease Type and Term Length

The structure and duration of your copier lease agreement directly shape your monthly payments and long-term costs. With commercial copiers ranging from a few thousand to over $50,000, the lease type is your roadmap for how you’ll pay for the asset over time.

The Fundamental Difference: Lease vs. Rent vs. Purchase

Before diving into specifics, it’s important to understand your three main options. Leasing is a long-term commitment (typically 36-60 months) with predictable payments and an option to buy the equipment at the end. Renting is a flexible, short-term solution ideal for temporary needs, though it comes with a higher monthly cost. Purchasing means you own the asset outright, which requires significant upfront capital but eliminates monthly payments.

For most businesses, leasing hits the sweet spot. It offers lower monthly costs than renting, predictable budgeting, and access to newer technology through regular upgrades. Lease payments are also often tax-deductible as an operating expense. The table below breaks down the key differences.

| Feature | Copier Lease | Copier Rental | Copier Purchase |

|---|---|---|---|

| Commitment | Long-term (36-60 months) | Short-term (days to months) | Permanent |

| Ownership | Lessor owns, option to buy at end | Lessor owns | Your business owns |

| Upfront Cost | Low to none | Low to none | High |

| Monthly Cost | Moderate, fixed | High, flexible | None (after purchase), but ongoing maintenance |

| Maintenance | Often included in service agreement | Usually included | Your responsibility, separate service contract |

| Technology | Access to latest models, easy upgrades | Latest models for short periods | Becomes outdated, upgrade at your cost |

| Best Use | Stable, long-term needs, cash flow management | Temporary projects, seasonal demand | Ample capital, long-term use, value asset ownership |

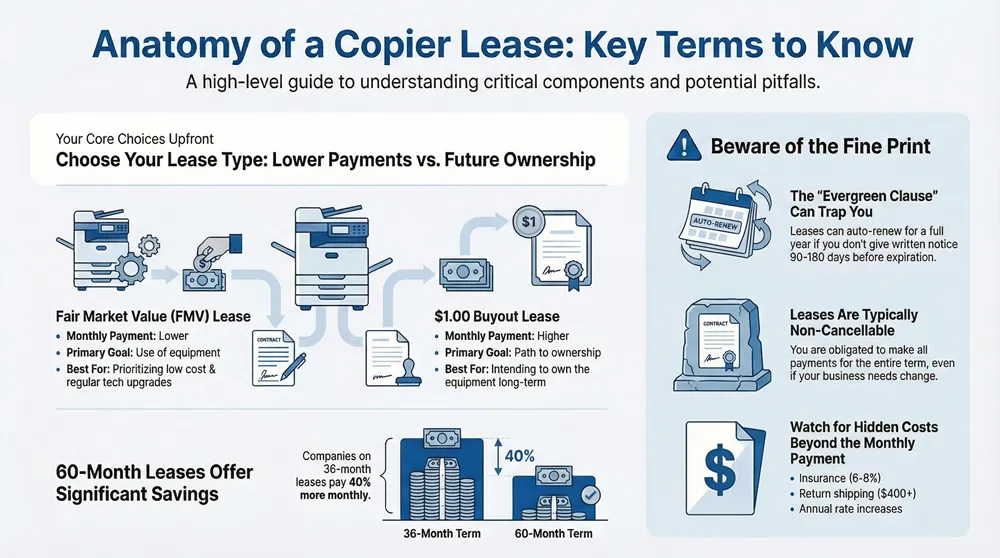

The Two Main Types of Copier Lease Agreements

Once you decide to lease, you’ll encounter two primary agreement types that affect your payments and end-of-lease options.

A Fair Market Value (FMV) lease offers the lowest monthly payments because you are paying to use the equipment, not to own it. At the end of an FMV lease, you can return the copier, renew the lease, upgrade to a new model, or purchase it at its current fair market value. This is ideal if you prioritize low monthly costs and want to upgrade technology regularly. You can learn more about Fair Market Value and how it’s determined.

A $1.00 Buyout lease functions like an installment plan. Monthly payments are higher because they build toward ownership. At the end of the term, you can purchase the copier for just $1.00. This makes sense if you intend to own the equipment long-term, as it appears as an asset on your balance sheet and can be depreciated.

Choosing Your Term Length: 36 vs. 60 Months

The length of your lease term dramatically impacts your monthly budget. A key industry statistic reveals that companies on 36-month leases pay 40% more than those choosing 60-month terms due to the significantly higher monthly payments.

A 36-month lease offers faster access to new technology, which is beneficial if you rely on cutting-edge features or anticipate rapid business changes.

However, a 60-month lease provides the best balance of cost and functionality for most businesses. The lower monthly payments ease budgeting, and modern copiers are built to last well beyond this term (the average lifespan is 72-78 months). The trade-off is simple: lower monthly payments with a longer term versus more frequent tech upgrades with a shorter one. For most businesses with stable needs, the cost savings of a 60-month lease deliver the best value in copier lease agreements.

2. Decode the Fine Print in Your Copier Lease Agreement

The costliest mistakes in copier lease agreements are often buried in the terms and conditions that many business owners skim over. Leasing companies know that busy executives focus on the monthly payment, but hidden clauses can cost you thousands and trap you in unfavorable contracts.

Automatic Renewal Clauses and Notice Periods

Perhaps the most common trap is the automatic renewal clause, also known as an “evergreen clause.” These clauses require you to provide written notification, typically 90 to 180 days before your lease expires, if you wish to terminate it. If you miss this deadline, the lease automatically renews, sometimes for another full 12-month term at the same rate.

To avoid this, carefully read your contract for language about “notice periods” and “automatic renewal.” Once you find the deadline, immediately put a reminder in your calendar. Sending written notice that you are evaluating your options is a safe step, even if you are undecided.

Early Termination Penalties and Non-Cancellable Terms

Unlike a gym membership, copier leases are typically non-cancellable agreements. Once you sign, you are obligated to make every payment for the entire term, even if your business downsizes or your needs change. Your only option to exit early is usually a buyout, which means paying the remaining balance of all future payments, often plus additional fees.

While some agreements offer mid-term upgrade options, these typically involve rolling your remaining balance into a new, longer lease. This may get you new equipment, but it also extends your financial commitment.

Uncovering Hidden Costs and Fees

Beyond the monthly payment, several other costs can impact your budget. Be on the lookout for these common fees in the fine print:

- Insurance: Can add 6-8% to your monthly payment if you don’t have existing business equipment coverage.

- Documentation Fee: A one-time upfront charge.

- Property Taxes: Some regions allow leasing companies to pass property taxes on the equipment through to you.

- Shipping Costs: Returning the equipment at the end of the lease can cost $400 to $800 or more.

- Late Payment Fees: Penalties for missing payment deadlines.

- Annual Rate Increases: While a 10% annual increase on a service plan may be justifiable, an increase on the equipment lease payment itself is a major red flag. A seemingly small 10% annual escalation can compound over time, significantly increasing your total cost.

Understanding these potential extras is essential for accurate budgeting. For comprehensive support that goes beyond just equipment, explore our IT services that complement your office technology needs.

3. Verify the Service and Maintenance Inclusions

A copier lease is often split into two parts: the equipment lease and the service agreement. You must know exactly what is covered to ensure your machine stays operational without incurring surprise repair bills. An idle copier means lost productivity, and a solid service agreement is your best protection.

What a Standard Service Level Agreement (SLA) Covers

A good Service Level Agreement (SLA) within your copier lease agreement is your safety net against downtime. Key elements to verify include:

- Guaranteed Response Time: Specifies how quickly a technician will arrive, often same-day or next-business-day.

- On-Site Repairs: Confirms that technicians will come to your office for all service calls.

- Parts and Labor: Should be comprehensive, covering everything from rollers to circuit boards. Note any exclusions, such as damage from misuse.

- Consumables: Most agreements include toner and drums, which is a major convenience.

- Uptime Commitment: Premium SLAs may guarantee the machine will be operational for a certain percentage of time (e.g., 98%).

For a more holistic approach, managed print services can optimize your entire printing infrastructure, turning a potential headache into a competitive advantage.

Understanding Your Copier Lease Agreement’s Cost-Per-Copy

The Cost-Per-Copy (CPC) structure is where many budget surprises occur. Your agreement will specify an included monthly volume (e.g., 5,000 black-and-white prints). If you exceed this, overage rates apply, which are typically higher than your base rate.

Pay close attention to the difference between black-and-white and color costs. A color print can cost six times more than a monochrome one (e.g., $0.069 for color vs. $0.011 for B&W). Since modern copiers track every page, it’s crucial to estimate your volume accurately before signing. Overestimate, and you pay for prints you don’t use; underestimate, and you’ll face high overage charges.

Leasing a Used vs. New Copier

The choice between a used or new copier is a balance of budget versus features and reliability.

Leasing a new copier provides access to the latest technology, such as mobile printing and advanced security, along with a full manufacturer’s warranty. This peace of mind comes with higher monthly payments.

Leasing a used copier can be a smart financial move, offering a quality machine at a lower cost. The key is to work with a reputable provider who has thoroughly refurbished and tested the equipment. While a well-maintained used copier can be very reliable, you should pay extra attention to its maintenance history and ensure your service agreement is comprehensive. The main trade-off is that older machines may lack the latest technology features.

4. Plan for the End of the Lease

What happens when your lease expires is determined by the lease type you chose at the start. Planning your end-of-lease strategy in advance prevents last-minute headaches and financial surprises. A surprising industry statistic shows that over 90% of all leases are upgraded at the end of the term, highlighting how much businesses value current technology.

Your Three Main End-of-Lease Options

As your copier lease agreement ends, you have three primary paths. The best choice depends on your budget, business needs, and satisfaction with the equipment.

- Return the Equipment: This is the simplest path for an FMV lease. You send the copier back and walk away. This is ideal if you no longer need the machine or want to switch vendors. Remember to budget for shipping costs.

- Purchase the Copier: This option makes you the owner. With an FMV lease, you can buy the copier at its fair market value, which is often negotiable. With a $1.00 buyout lease, you purchase it for the nominal $1.00 fee. This is logical if you intended to own the machine for its full useful life (averaging 72-78 months).

- Upgrade to a New Model: This is the most popular choice. You return the old copier and sign a new lease for a brand-new model, keeping your office technology current without the hassle of selling old equipment.

The Process of Returning or Buying Out the Copier

Whether returning or buying, the details matter. Failing to follow the process can lead to unexpected fees.

- Follow Instructions: The leasing company will provide specific return instructions for packaging and logistics. Follow them precisely.

- Ensure Data Security: Before the copier leaves your office, you are responsible for permanently wiping all sensitive data from its internal hard drive. Modern copiers store images of scanned and printed documents, posing a significant security risk if not properly erased.

- Budget for Shipping: The responsibility and cost of shipping almost always fall on you. Factor this into your budget from the beginning.

- Negotiate the Buyout: If you have an FMV lease and want to purchase the copier, treat the leasing company’s initial buyout price as a starting point for negotiation. Research the market value of similar used equipment to strengthen your position.

Frequently Asked Questions about Copier Lease Agreements

Considering a copier lease agreement brings up important questions. Getting clear answers upfront can save you thousands of dollars and future headaches.

What is the most common pitfall in a copier lease?

The biggest trap is the automatic renewal clause, or "evergreen" clause. Most leases don't simply expire; they require you to provide written notice 90 to 180 days before the term ends to prevent it from renewing. If you miss this window, the lease can automatically extend for another full year, forcing you to pay for a machine you may no longer want or need.

Does a copier lease include toner and maintenance?

Yes, but typically through a separate service agreement that is bundled with the equipment lease. This agreement is usually structured on a cost-per-copy (CPC) basis, covering toner, parts, labor, and routine maintenance. It's critical to confirm exactly what is included and what constitutes an overage, as extra prints are billed at a higher rate. Also, check for annual rate increases on the service plan.

When does it make more sense to buy a copier instead of leasing?

Buying is often the smarter financial choice if you have the upfront capital, your printing needs are stable and low-volume, and you plan to use the machine for its entire lifespan (typically 6+ years). While leasing preserves cash flow and offers easy upgrades, purchasing usually results in a lower total cost of ownership over the long run by eliminating monthly payments and end-of-lease fees like shipping.

Conclusion: Sign with Confidence

By checking these five key areas—lease type and term, fine print, service inclusions, end-of-lease options, and your leasing partner—you can turn a daunting contract into a strategic business decision. This roadmap for your copier lease agreement makes the process manageable.

An informed approach ensures you get the right technology at a fair price, without the stress of hidden costs or inflexible terms. When you understand the difference between an FMV and a $1 buyout lease, calculate the true cost of different term lengths, and plan for the end of the contract, you are in control.

Armed with this knowledge, you can confidently negotiate terms that work for your business and avoid costly pitfalls. For a partner that prioritizes transparency and expert guidance, helping businesses nationwide make smart office technology decisions, consider the experts at 1-800 Office Solutions.

Ready to find the perfect copier for your business? Get a transparent commercial copier lease quote today.