Starting a New Business? Tools to Get Business Tax Help and Stay Compliant

Starting a new business is exciting. You’re thinking about your product, putting up your website, getting social media right, and closing your first sale. Tax is definitely the last thing on your mind. But the truth is that the tax man will always come calling, and when he does, you don’t want to be caught scrambling. You don’t want to be celebrating a new customer one moment, and the next, you’re asking ChatGPT about sales tax and 1099 forms.

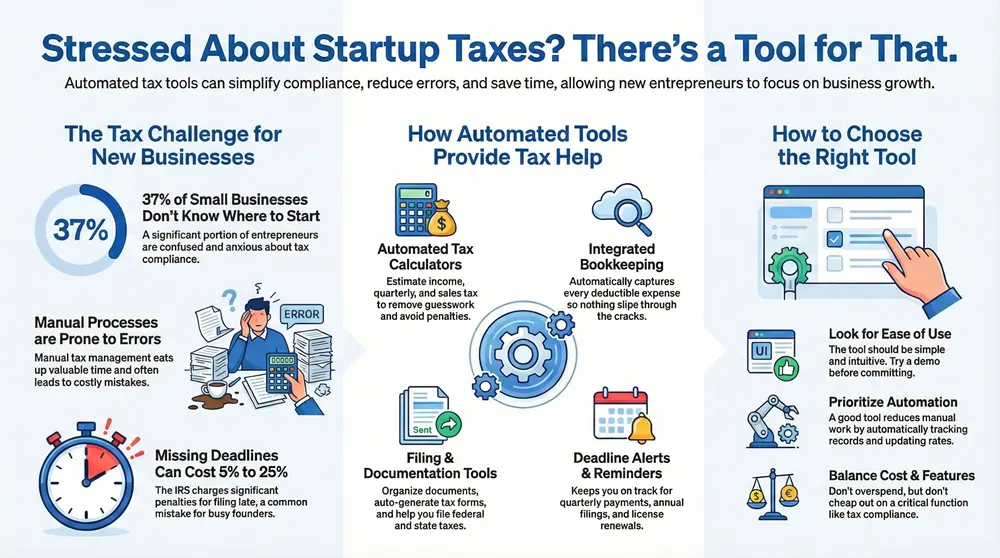

But this is actually a problem many businesses face. In fact, up to 37% of SMEs in the U.S. have no idea where to start when it comes to business tax, according to American University, Washington. Come tax season, everyone is confused and anxious.

The good news? You don’t have to figure everything out the hard way. There are simple tools designed to give you the business tax help you need so you can stay compliant while focusing on what you do best, building your business.

How Tools Can Provide Business Tax Help

When we talk about “tools” for business tax help, we mean simple but smart software that handles the grunt work of tax management so that you don’t have to.

And these aren’t just fancy calculators. Many of the modern tax tools for business integrate with your bank accounts, payment processors, and accounting systems. They track your income and expenses automatically, categorize transactions, so you know what’s deductible, and even remind you when deadlines are approaching.

And it all works, in fact, so well that the market for these tools is expected to hit $47.21 billion by 2032. Why? Because businesses are tired of the manual tax processes that eat up time and are full of errors.

AI takes things a step further. PwC reports that AI streamlines tax processes, reduces errors, and offers real-time compliance insights. And you know the best part? These business tax help tools don’t require a degree to understand and use. Some platforms even put everything in one place: formation, business tax help, bookkeeping, analytics, and more. They’re built for busy entrepreneurs who just need things to work.

Now, let’s look at the key types of tools that provide solid business tax help.

Automated Tax Calculators

Automated tax calculators can help you know exactly what your tax obligation for the tax year is without digging through tax guides or making wild guesses.

How it works is pretty simple: just enter your numbers and the tool does the math.

Automated calculators remove guesswork by estimating:

- Income tax

- Estimated quarterly taxes

- Sales tax (if applicable)

This way, you don’t underpay or get hit with unwanted surprise penalties. For new business owners trying to navigate the uncertain terrain of taxation, these calculators can be a lifesaver.

Integrated Bookkeeping and Reports

Good bookkeeping is the foundation of a successful business, and for first-time business owners juggling multiple roles, this tool can be a very big help.

It helps businesses:

- Capture every deductible expense

- Avoid mistakes

- Make smarter financial decisions

With tools like this, you can be sure that nothing will slip through the cracks. Come tax season, everything is sorted out and ready to go. Fewer mistakes, more deductions, and less stress.

Filing and Documentation Tools

Most tax issues begin with messy filing and missing documentation. This is understandable because first-time founders often don’t know which forms to file or when. Tax filing and documentation tools like this one on this site can help with this by:

- Organizing your documents

- Auto-generating tax forms

- Helping you file federal and state taxes

- Keeping everything stored and accessible

Some also take providing business tax help a step further by guiding what should be done at both the federal and state levels.

Alerts and Reminders

Missing a deadline is one of the most common and costly mistakes business owners make when it comes to taxes. And the IRS is not too forgiving about it. Late filings can attract a penalty of between 5% and 25% of the tax owed.

Alerts and reminders help prevent this by reminding you of:

- Quarterly tax deadlines

- Annual filings

- License renewals

- Document expirations

Tools like these, according to Doola, keep you on track so you file on time, every time. The goal is to avoid any last-minute panic, stay on top of your tax situation, and keep your business rolling smoothly.

Choosing The Right Help Tool For Business Tax

You have enough on your plate as a new business owner; picking software shouldn’t be an additional headache. Here’s how to make the right selection.

- Look for Ease of Use: The very first thing you should consider when choosing a business tax help tool is how easy it is to use. Go for a complex option, and the purpose of a help tool is defeated. If possible, sign up for trial or demo versions so you can see how the tools work in real life.

- Verify Coverage: You also want to be sure that the tax help tool you’re going for can do the job you want it to do. Does it cover every state or even country that you plan to sell to? Verify that it covers the VAT/GST of your target market.

- Prioritize Automation: The entire point of using business tools is to reduce as many manual processes as you can. So, check that the tool you’re going for supports automation. You want to be able to track Nexus, organize records, and update tax rates automatically.

- Look at Cost: The U.S. Chamber of Commerce cites cash flow problems as one of the reasons small businesses fail. So, it’s important that you keep an eye on how you spend money in your new business. Don’t overspend on fancy tools, but also, don’t cheap out on something as critical as tax compliance. Strike the right balance.

Final Thoughts

Starting a business from scratch takes courage and optimism. The right tools help protect both. As a new business owner, you don’t want to stretch yourself thin by doing everything manually, and you don’t need to strain your finances by hiring a tax professional too early.

Practical business tax help tools like the ones we’ve discussed in this article can be your lifesaver, especially in the early stages of your business.

They’ll help keep you organized, compliant, and focused on building your business, not battling paperwork.