The Fine Print of Copier Lease Agreements Made Simple

AI Overview:

This blog breaks down why copier lease agreements are one of the most important long-term financial commitments a business can make. With lease terms typically lasting 36–60 months, these contracts influence cash flow, daily operations, technology access, and total printing costs for years. The guide helps readers understand the fine print, avoid hidden fees, and confidently negotiate favorable terms.

Why Copier Lease Agreements Matter for Your Business

A copier lease agreement is a binding contract for renting office equipment, typically for 36-60 months. Understanding these agreements is crucial, as they represent a significant financial commitment that can impact your business for years. A poorly understood lease can lead to thousands in unexpected fees.

Key Components of a Copier Lease Agreement:

- Lease Type: Fair Market Value (FMV) vs. $1 Buyout.

- Payment Terms: Monthly rates, overage charges, and hidden fees.

- Equipment Specifications: Print speeds, color capabilities, and features.

- Service Obligations: Maintenance, repairs, and supply duties.

- End-of-Lease Options: Purchase, return, upgrade, or renewal.

- Termination Clauses: Early exit penalties and automatic renewals.

The complexity of these contracts is why businesses must understand the fine print before signing. With lease terms spanning 3-5 years and payments from $50 to over $1,000 monthly, the financial stakes are high.

However, a well-understood lease is a powerful tool for managing cash flow, accessing modern technology, and ensuring predictable costs. This guide breaks down everything you need to negotiate confidently and avoid costly mistakes.

Understanding Your Options: Leasing, Renting, and Buying

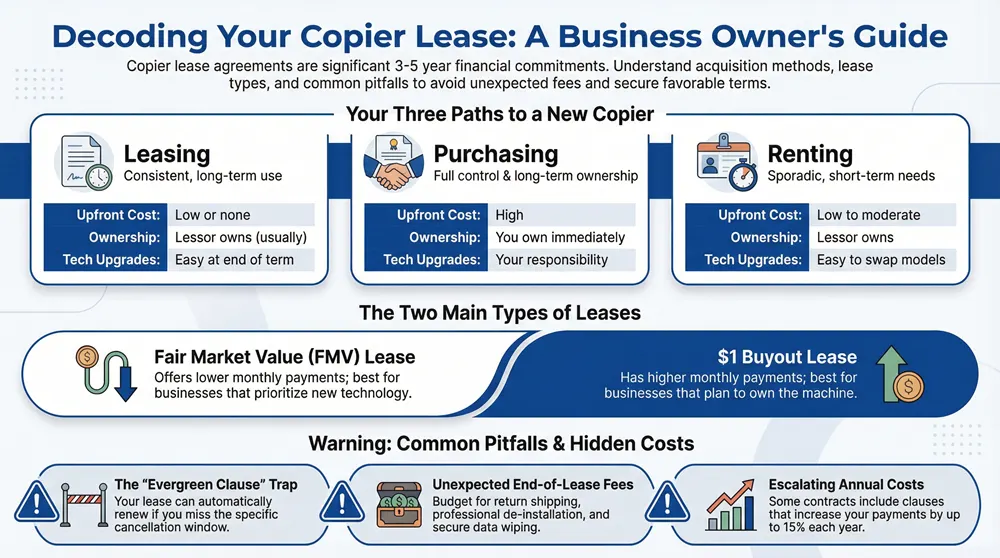

When acquiring a copier, you have three main paths: leasing, renting, or buying. Each affects your cash flow, technology access, and long-term costs differently.

Copier leasing is a popular choice for many businesses due to its significant advantages.

- Lower Upfront Costs: Get a high-quality machine without a large capital outlay.

- Tax Benefits: Monthly lease payments often qualify as tax-deductible business expenses.

- Access to Latest Technology: Upgrade to newer, more efficient models at the end of your lease term.

- Improved Cash Flow: Free up capital for other growth-focused investments like marketing or inventory.

For businesses exploring leasing, our copier lease services offer solutions custom to your needs.

| Feature | Copier Lease | Copier Rental | Copier Purchase |

|---|---|---|---|

| Duration | Long-term (typically 3-5 years) | Short-term (day, week, month) | Indefinite |

| Upfront Cost | Low or none | Low to moderate | High |

| Monthly Payments | Predictable, fixed | Flexible, can vary | None (after purchase) |

| Ownership | Lessor owns (unless $1 buyout) | Lessor owns | You own |

| Maintenance & Service | Often included in agreement | Usually included | Your responsibility |

| Technology Upgrades | Easy at end of term | Easy to swap models | Your responsibility |

| Flexibility | Less flexible (contract) | Highly flexible | Full control |

| Cost-Effectiveness | For consistent, long-term use | For sporadic, temporary use | Long-term if budget allows |

| Tax Implications | Payments potentially deductible | Payments potentially deductible | Depreciation, Section 179 |

Types of Copier Leases

Not all copier lease agreements are the same. The two most common types are:

- Fair Market Value (FMV) Lease: Also known as an Operating Lease, this is the most popular option. It offers lower monthly payments because you’re paying for usage, not ownership. At the end of the term, you can buy the copier at its current market value, renew the lease, or return it. FMV leases are great for businesses that want to stay current with technology.

- $1 Buyout Lease: Also called a Capital Lease, this is essentially a financing agreement. Monthly payments are higher because they cover the full purchase price over time. At the end of the lease, you pay $1 and own the machine. This is ideal for businesses that intend to keep the equipment long-term.

Other options include Fixed Purchase Option leases (buy for a predetermined price) and Installment Purchase agreements. The choice comes down to whether you prioritize lower monthly payments and flexibility (FMV) or eventual ownership ($1 Buyout).

Leasing vs. Renting a Copier

While similar, leasing and renting serve different purposes.

- Leasing is a long-term commitment (3-5 years) with predictable monthly payments, ideal for consistent, ongoing business needs.

- Renting is short-term and flexible (day, week, month), perfect for temporary needs like a special project, tax season, or a temporary office.

Renting is more expensive for long-term use, while leasing provides stability and better rates for everyday operations.

Leasing vs. Purchasing a Copier

This decision balances cash flow, control, and technology.

Purchasing requires significant upfront capital ($3,000-$15,000+), but you own the asset and have full control. Long-term, it can be cheaper as you avoid interest and fees. However, you are responsible for all maintenance (often 20% of purchase price annually) and are stuck with the technology as it ages.

Leasing preserves capital and solves the problem of technology obsolescence. You can upgrade to newer, more secure, and efficient models at the end of your term. Most leases also bundle maintenance, repairs, and supplies like toner into a predictable monthly payment, eliminating surprise repair bills.

For businesses that value predictable costs, capital preservation, and current technology, leasing is often the best choice.

To explore our equipment options, visit our products page.

The Anatomy of a Copier Lease Agreement

When you sit down with a copier lease agreement, you’re reviewing a multi-year financial commitment that can affect day-to-day operations. These contracts are written to protect the lessor first. Knowing the structure and fine print lets you negotiate smarter terms and avoid surprises. The service component matters most for uptime—clarify what’s covered, expected response times, and any exclusions before you sign.

Key Terms and Conditions to Scrutinize

- Lease term: 36-60 months is typical. Longer terms lower monthly payments but increase total cost and lock you into older tech.

- Payment schedule and late fees: Penalties are often steep.

- Default clause: Defines remedies if you breach terms (accelerated payments, repossession). Read carefully.

- Insurance: You must maintain coverage for full replacement value and liability; otherwise expect lessor’s coverage.

- Liability: Risk is usually on you—even for wear, accidents, or natural events—so confirm insurance adequacy.

- Termination: Early exits often require paying all remaining payments, plus possible device fees.

- Assignment: Lessors can often sell/assign your lease without consent; you usually need permission to transfer.

Understanding the Full Cost Structure of a Copier Lease Agreement

Your monthly payment is only part of the total. Budget for:

- Overage charges: Per-page costs when you exceed the included volume.

- Cost-per-copy: B&W pages can be ~pennies; color is higher. Confirm whether costs are bundled or separate.

- Maintenance/parts/supplies: Often included for predictability. Our Managed Print Services explain coverage depth.

- One-time documentation fee.

- Insurance fees.

- End-of-lease costs: Return processing, FMV buyout prices, and return shipping depending on size and distance.

Common Pitfalls and Hidden Costs

- Automatic renewal (Evergreen Clause): If you miss the written notice window (commonly 60-120 days before end), the lease can renew for another year. These clauses automatically extend your contract unless you provide written notice within a specific timeframe.

- Escalation clauses: Annual increases (sometimes up to 15%) on payments or per-copy rates add up over multi-year terms.

- Return shipping: Copiers are heavy (300+ lbs). You pay freight and de-installation—plan.

- Data security: You’re responsible for securely wiping internal storage before return to prevent exposure of printed/scanned/faxed data.

- Weak SLAs: Vague service terms cause downtime. Insist on clear response/repair commitments and what’s covered.

Understanding these items puts you in control of costs, service quality, and end-of-term outcomes.

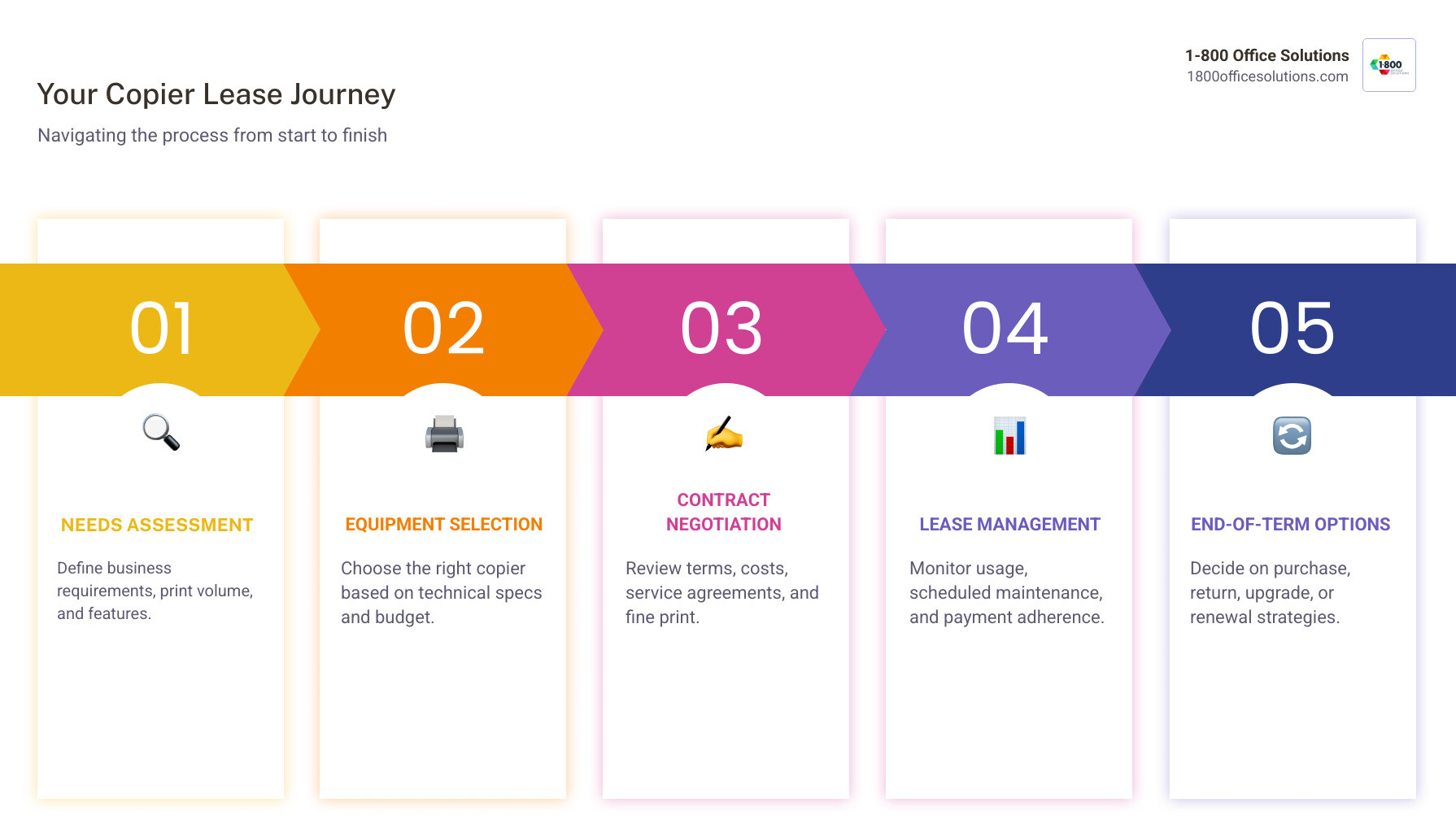

Selecting the Right Copier and Structuring Your Lease

Choosing the right copier requires an honest assessment of your business needs to avoid paying for unused capacity or being stuck with an inefficient machine.

Start by analyzing your current and projected print volume. Don’t guess—use printer reports to get an accurate count. Factor in reasonable growth, but avoid overestimating, as it’s easier to upgrade later than to pay for a machine that’s too large.

Equally important is feature selection. Do you need automatic stapling or hole-punching? Is color printing essential for client materials, or is it a “nice-to-have”? Choosing a lease term that aligns with your technology refresh cycle helps future-proof your investment and prevents you from being locked into outdated equipment.

Integrating your copier selection with broader technology planning is smart. Our IT services can help ensure all your office equipment works together seamlessly.

Copier Capabilities and Technical Specifications

Understanding key specs helps you match a machine to your workflow.

- Print Speed (PPM): A 45 PPM machine costs more than a 25 PPM one. Only pay for the speed you truly need for your typical job size.

- Color vs. Black & White: Color is essential for marketing or real estate firms but may be an unnecessary expense for law or accounting offices.

- Paper Capacity: High-volume environments need larger or multiple paper trays to maintain productivity.

- Finishing Options: Features like stapling, hole-punching, and booklet-making save significant manual labor on reports and presentations.

- Security Features: Essential for protecting sensitive data. Look for user authentication, data encryption, and secure print release. Our cybersecurity solutions can provide comprehensive protection.

- Network Connectivity: Ensure the copier supports Ethernet, Wi-Fi, and mobile printing to fit a modern, flexible workplace.

Choosing the Right Lease Duration

The lease term in your copier lease agreement is a long-term financial and operational commitment.

- Short-term (36 months): Offers the most flexibility to upgrade technology sooner. The higher monthly payment may be worthwhile for rapidly evolving businesses or those with heavy usage.

- Mid-term (48 months): A popular balance between manageable monthly payments and the ability to refresh technology before it becomes obsolete.

- Long-term (60+ months): Provides the lowest monthly payments, which is great for cash flow. However, the total cost over the lease is higher, and you’re committed to the same technology for five or more years.

Consider your company’s typical technology refresh cycle. Aligning your copier lease with other equipment upgrades (like computers) is a smart strategy. While early termination is an option, the penalties often negate any savings from a lower monthly payment.

A copier lease agreement is a multi-year partnership. Choose a reputable vendor, negotiate assertively, and track key dates and usage from day one to avoid fees and forced renewals.

How to Effectively Negotiate Your Copier Lease Agreement

- Leverage competition: Get at least three quotes. Ask preferred vendors to match or beat the best price or service terms.

- Question every fee: Documentation fees, insurance add-ons, delivery/installation, and removal—ask for waivers or reductions.

- Nail down service levels: Request specific commitments (e.g., 4-hour critical response, next-day parts, loaners if repairs exceed a set timeframe).

- Clarify upgrade paths: Ensure options for mid-term upgrades or favorable trade-ins at renewal if you prioritize new tech.

- Come prepared: Know monthly volumes, budget, and growth plans to strengthen your bargaining position.

Managing End-of-Lease Options

- Lease buyout: A no-brainer for $1 buyouts; for FMV, compare market value against the machine’s age, cost-per-copy, and current needs.

- Lease renewal: Don’t auto-renew—use your clean payment history to negotiate better rates or improved service terms.

- Equipment upgrade: Start 6-12 months early to lock in timing and pricing for newer, faster, more secure models.

- Equipment return: Plan for logistics, data wiping, condition standards, and possible return/processing fees.

For quotes and help comparing paths, visit our commercial copier lease quotes page.

The Process for Early Termination and Equipment Return

- Review the termination clause: Penalties are often the sum of remaining payments plus any flat device fee.

- Do the math: Compare total penalties vs. the operational benefit of exiting now.

- Notify the lessor in writing: Many contracts require 60-120 days’ notice for termination or non-renewal.

- Prepare the device: Return it in good working condition (normal wear is fine) to avoid damage charges.

- Budget for shipping: Commercial copiers (300+ lbs) require freight—typically $300-$1,200 depending on size and distance. When shipping a copier, ask about insurance requirements, packaging specifications, delivery timeframes, freight costs, and whether professional de-installation is included.

- Document condition: Photograph/video the device powered on, printing, and any cosmetic wear before pickup.

- Wipe all data: Permanently delete everything stored on internal drives to avoid security risks and fees.

Frequently Asked Questions about Copier Lease Agreements

We’ve helped countless businesses steer copier lease agreements. Here are answers to the most common questions we encounter.

What are the main types of copier lease agreements?

There are two primary types of copier lease agreements:

Fair Market Value (FMV) Lease: Also known as an Operating Lease, this offers lower monthly payments. At the end of the term, you can buy the copier at its current market value, renew the lease, or return it. It's ideal for businesses that prioritize flexibility and access to current technology.

$1 Buyout Lease: Also called a Capital Lease, this is for businesses that intend to own the equipment. Monthly payments are higher, but you gain ownership for just $1 at the end of the term.

Other variations include Fixed Purchase Option leases and Installment Purchase agreements.

How can I get out of a copier lease early?

Exiting a copier lease agreement early is possible but usually costly. The process involves:

Reviewing your contract's termination clause to understand the penalties, which often equal the sum of all remaining payments plus additional fees.

Providing formal written notice to the leasing company.

Paying the required penalties.

In some cases, you might negotiate a buyout or transfer the lease to another business (with the lessor's approval). While expensive, early termination can be the right move if your business needs have changed dramatically.

What is an "Evergreen Clause" in a copier lease?

An Evergreen Clause is an automatic renewal provision and a major financial trap. If you fail to provide written notice that you are terminating the lease within a specific window (e.g., 60-120 days before the end date), your contract automatically renews for another term, often a full year. This can lock you into thousands of dollars in payments for equipment you may no longer want. To avoid this, always send a non-renewal notice well in advance of the deadline.

Conclusion

Smart decisions about a copier lease agreement protect your bottom line and set your business up for operational success. The most important takeaway is to never sign without understanding every detail.

Compare lease types (FMV vs. $1 Buyout), scrutinize every clause—especially Evergreen provisions—and calculate the true total cost, including potential end-of-lease fees like return shipping. Knowledge is your power in negotiations. Use the insights from this guide to question fees, secure better service levels, and avoid common traps.

We have seen countless businesses leverage leasing to improve cash flow and access modern technology. The difference is preparation. By applying what you’ve learned, you can negotiate from a position of strength.

Our philosophy is to empower clients with information first and solutions second, building lasting partnerships and avoiding costly surprises.

Ready to put this knowledge to work? Get a commercial copier lease quote and experience the difference that transparency and expertise make.