What is the BAI2 File Format for Professionals

AI Overview:

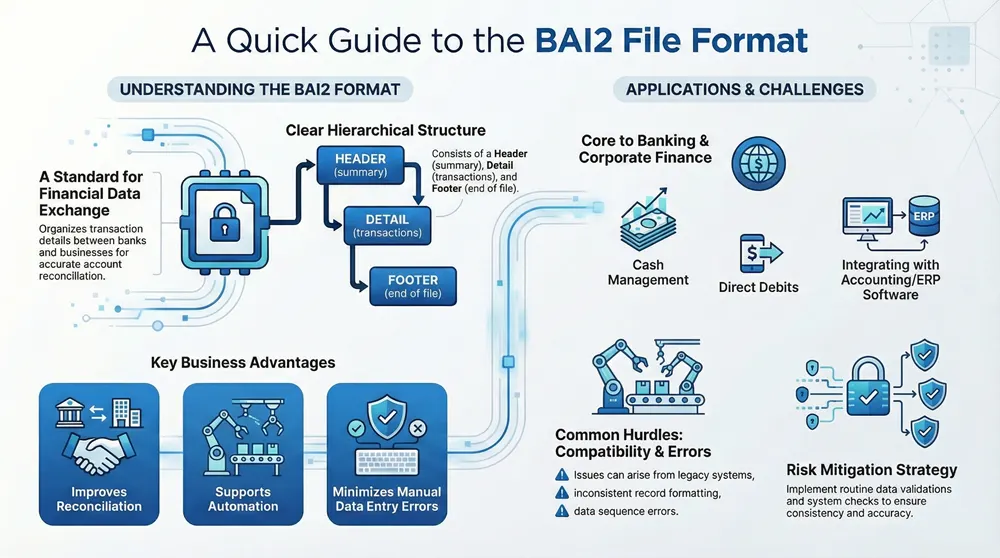

The BAI2 file format is a standardized financial data format used to organize, transmit, and reconcile transaction information efficiently. This blog explains how BAI2 files are structured, where they are commonly used, and why they remain essential for banking, accounting, and ERP integrations. It highlights key benefits such as reduced manual errors, improved reconciliation, and support for automation, while also addressing common challenges like system compatibility and data validation. Overall, the article shows how BAI2 helps businesses streamline financial workflows and maintain accurate, secure data processing.

What is the BAI2 File Format: Definition and Key Insight

Does the structure of a BAI2 file often leave you confused? This article explains the BAI2 File Format by outlining its structure, common applications, and the challenges associated with it. Readers will learn how to navigate the file format confidently and gain expert insights into managing office equipment data securely. The information provided helps alleviate problems with file processing and streamlines important data handling tasks for businesses.

Key Takeaways

- the bai2 file format organizes financial data with clear sections

- it simplifies bookkeeping for office equipment management

- it supports system integration with various erp applications

- it minimizes manual errors through structured data handling

Understanding the BAI2 File Format

The article examines the BAI2 file format through its definition, key characteristics, and practical applications. It outlines how the format serves as a specification for various documents, including invoice and cheque data. The discussion builds a knowledge base for understanding its role and use cases in processing financial documents efficiently.

Defining the BAI2 File Format

The bai2 file format organizes a variety of data with precision, ensuring that each element, such as the header and transaction details, is clearly defined. This format plays an important role when handling records involving fee structures and financial instruments like a letter of credit.

The format’s structure simplifies the processing of data, making it easier for organizations to manage invoice communications effectively. Key elements, including the header and specific identifiers, offer transparency and consistency in handling fee calculations and letter of credit details.

Key Characteristics of BAI2 Files

The BAI2 file format exhibits several practical qualities ideal for modern bookkeeping and financial services. Its well-defined structure supports integration with erp systems and offers a robust infrastructure for processing transaction details, as outlined by the american national standards institute guidelines.

Distinct markers in the BAI2 files aid in consolidating data from various financial sources. The format’s clear delineation of transaction elements allows firms to streamline operations in bookkeeping and financial services while ensuring compatibility with erp applications and maintaining adherence to american national standards institute recommendations.

Purpose and Use Cases of BAI2 Files

The file format serves to streamline accounting tasks by organizing text file data into manageable sections that include details from bank statements, money transactions, and currency values:

The file format not only reduces manual effort but also ensures that data concerning bank statements, money, and currency is recorded accurately. This structure provides practical insights for system integration and workflow improvements in financial data management.

Structure of the BAI2 File Format

This section outlines the BAI2 data layout, key fields, and hierarchical relationships essential for bank reconciliation. It covers number identifiers, xml integration, asc x12 comparisons, and debit card transaction details, providing a concise overview that connects each detailed topic for practical and efficient financial document management.

Overview of BAI2 Data Layout

The BAI2 data layout organizes essential information for payment processing and record keeping in a manner that supports automation across systems. It offers clear distinctions between sections, ensures pdf conversion and storage, and provides solid credit data that serves institutions relying on lockbox processing to streamline workflows:

- Clearly defined header and detail sections

- Consistent field identifiers for payment and credit details

- Robust data grouping to support automation and pdf generation

- Efficient layout beneficial for lockbox reconciliations

The structure facilitates quick access to financial records and improves operational fluidity. The layout provides business owners with actionable insights on how data organization benefits accuracy in credit accounting, payment verification, and lockbox activities.

Identifying Key Fields and Sections

The BAI2 file format organizes key fields to support robust data management in finance and accounting environments. The document structure marks essential sections to streamline procedures such as wire transfer documentation and NACHA compliance, ensuring that financial records are efficiently processed and easily accessible for accurate reporting.

Critical sections include header identifiers and transaction details that ensure consistency and traceability across financial operations. These well-defined components enhance data management for finance professionals by providing clear documentation, which facilitates routine accounting tasks and wire transfer verifications, ultimately reducing processing time and error rates.

Understanding Hierarchical Relationships

The hierarchical structure organizes related data nodes clearly, grouping elements such as bank account information, debits and credits, and dishonoured cheque details to optimize software functionality and enterprise resource planning processes. The layout ensures that each component connects logically to its subsequent layer, streamlining data reconciliation and record maintenance:

The structure benefits organizations by offering a straightforward method to capture and process complex financial data, thereby reducing manual efforts. This system supports efficient management of transaction details and helps mitigate issues related to data errors or discrepancies encountered during processing through reliable software and structured enterprise resource planning integrations.

Common Applications of BAI2 Files

Industries such as banking and corporate finance depend on the BAI2 format for seamless data exchange. Financial institutions use this method to handle cash movement and integrate with accounting software, while protocols like iso 20022 and clearing house standards enable smooth operations. This section offers practical insights into the application and value of BAI2 files across key sectors.

Industries Relying on BAI2 Formats

Financial institutions and service providers rely on the BAI2 file format to ensure accurate parsing of transaction data, supporting solutions like online banking and direct debit systems. Organizations such as Westpac utilize these structured files to integrate API-driven processes that streamline key operations and reduce manual errors.

Corporations in banking and corporate finance depend on consistent data structures for effective direct debit tracking and online banking verification. The format assists in parsing complex financial information, enabling institutions to leverage API integrations and support systems like Westpac for secure and efficient processing.

How Financial Institutions Utilize BAI2 Files

Financial institutions use the BAI2 file format to streamline data exchange between banks and regulatory entities such as the federal reserve, ensuring accurate records in cash management operations. The format supports real-time reconciliation processes and integrates with swift messaging systems to maintain secure payment processing.

The application of BAI2 files in federal reserve interactions and cash management improves the efficiency of transaction processing while reducing discrepancies. Institutions rely on these structured documents to support swift communications and clear audit trails, which aid in timely decision-making and compliance with industry standards.

Advantages of Using the BAI2 File Format

The format simplifies financial data exchange, refines reconciliation processes, and supports automation in financial reporting. This section highlights practical insights into organizing data efficiently and reducing manual efforts. It offers expertise on optimizing financial operations through structured data handling, benefiting businesses focused on accurate record-keeping and improved data integration.

Streamlining Financial Data Exchange

The efficient design of the BAI2 file format accelerates the processing of financial data while reducing manual intervention. The configuration permits clear separation of transaction elements and provides a straightforward framework for exchanging data between banks and financial service providers.

The structured approach of the file format minimizes errors in financial reporting and supports automation in data transmission. Its robust layout facilitates real-time reconciliation and enhances the integration of accounting software with secure cash management systems.

Improving Reconciliation Processes

The BAI2 file format simplifies bank reconciliation by clearly delineating transaction records, enabling seamless cross-verification of payments and credits. This method helps businesses reduce ambiguity and streamline data matching procedures, which ultimately cuts down on process delays and promotes timely financial tracking.

Using structured BAI2 files improves reconciliation processes by systematically organizing financial data for efficient comparison and validation. This setup minimizes manual review errors and enhances the accuracy of audit trails, meeting the detailed requirements of business accounting practices.

Supporting Automation in Financial Reporting

The BAI2 format facilitates automation in financial reporting by organizing data into clearly defined sections that streamline processing tasks. This method reduces manual input and improves data accuracy, providing businesses with a reliable framework for efficient record-keeping and timely financial insights.

The structured layout of BAI2 files supports seamless integration with accounting software, enabling automated reports that reflect real-time financial positions. This approach minimizes delays and errors in reporting, offering practical solutions to the challenges faced by businesses in maintaining precise financial records.

Challenges Involved With BAI2 Files

Compatibility issues with different systems, common errors in BAI2 file processing, and methods for mitigating risks are key challenges that organizations face. The following sections provide practical insights into these hurdles and offer clear strategies to improve system integration, minimize errors, and ensure secure data processing.

Compatibility Issues With Different Systems

The BAI2 file format sometimes encounters integration challenges when interacting with various systems due to differences in data handling protocols:

The format’s structured design may not align perfectly with the processing rules of all technological environments, which in some instances leads to difficulties in data interpretation. Organizations face these challenges by adjusting system configurations and seeking guidance from experienced office equipment suppliers to ensure error-free file integration with various platforms.

Common Errors in BAI2 File Processing

The processing of BAI2 files can result in errors arising from inconsistencies in record formatting and unexpected data sequences. Business owners and system administrators observe that misaligned field delimiters and unexpected character entries often disrupt the accurate capture of transaction data.

Experienced professionals identify misinterpreted transaction codes and incomplete footer sections as common culprits in BAI2 file processing. Organizations benefit from routine validations and thorough system checks to detect and correct these errors, ensuring accurate financial record management.

Mitigating Risks When Using BAI2 Files

Organizations mitigate risks when using BAI2 files by implementing routine validations and system checks to ensure consistency in data processing. The use of error detection protocols and collaboration with experienced office equipment supplier experts has proven effective in minimizing disruptions in daily operations:

- Regular system validations

- Enhanced error detection protocols

- Consultation with experienced professionals

Industry professionals recommend establishing standard operating procedures for error identification and correcting data mismatches to improve integration across platforms. These actionable measures help business owners maintain reliable financial operations while ensuring the structured format supports accurate record keeping.

Future of BAI2 File Format

Business owners gain insight into emerging trends in financial file formats and practical innovations impacting BAI2 usage. This section covers predictions for the evolution of BAI2 files, offering concise expertise on industry shifts that affect data integration and processing efficiency in office equipment management.

Trends in Financial File Formats

The financial sector sees gradual changes in the organization of file formats as businesses demand higher efficiency and reliability. Progressive organizations adopt structured data processing methods to reduce errors and improve workflow, a transformation observed among industry leaders.

These trends highlight the value of modern file formats in supporting efficient financial operations and data reconciliation. The updated structure offers a reliable framework for processing transactions, integrating advanced error-checking systems, and supporting common financial software interfaces:

Innovations Impacting BAI2 Usage

The industry observes practical advancements in file processing techniques as software upgrades support more dynamic handling of BAI2 files. Experts note that new error-checking protocols and enhanced data integration tools simplify the processing of financial transactions and offer measurable improvements in efficiency for businesses.

Recent innovations in automated reconciliation systems and real-time data validation actively reduce processing delays and minimize routine errors. Industry professionals advise business owners to adopt these updated solutions to secure accurate data management and streamline financial operations.

Predictions for the Evolution of BAI2 Files

Industry experts foresee a gradual transformation in the BAI2 file format as financial data processing evolves; enhanced error-checking protocols and increased automation drive greater integration between banks and accounting systems:

- Enhanced data validation steps.

- Simplified reconciliation processes.

- Seamless integration with modern ERP systems.

These predictions stem from extensive experience in working with structured financial data, offering clear benefits for organizations seeking to reduce manual efforts and improve operational accuracy with efficient data exchanges.

Frequently Asked Questions

What defines the Bai2 file format?

The Bai2 file format defines a standardized structure for presenting cash management data, enabling clear, organized transmission of transaction details and balance information between banks and businesses for accurate account reconciliation.

How is the bai2 file structured?

The bai2 file maintains a header with identifying information, followed by detailed group and transaction records, culminating in a trailer. Each section uses fixed-length fields to ensure precise data mapping for office equipment service management.

Where are bai2 files commonly used?

Bai2 files serve as index files in sequencing and bioinformatics, streamlining access to large datasets in high-performance computing systems.

What benefits do bai2 files provide?

bai2 files offer efficient data handling, compatibility with managed systems, secure encryption, and simplified archival processes, streamlining workflows for office equipment businesses while supporting reliable managed IT services and cybersecurity operations.

What obstacles appear with bai2 usage?

Obstacles may include integration issues with existing systems, limited support for certain environments, and potential compatibility challenges that influence both managed IT services and office equipment operations.

Conclusion

Understanding the BAI2 file format proves critical for organizations managing financial transactions and record keeping. Its clear structure and specific data sections streamline the process of reconciling accounts and verifying payments. The format supports integration with modern IT solutions and reduces the risk of errors in financial reporting. Business owners benefit from adopting these precise methodologies to enhance operational efficiency and secure accurate data integration.