Affordable Copier Leasing Made Easy and Wallet-Friendly

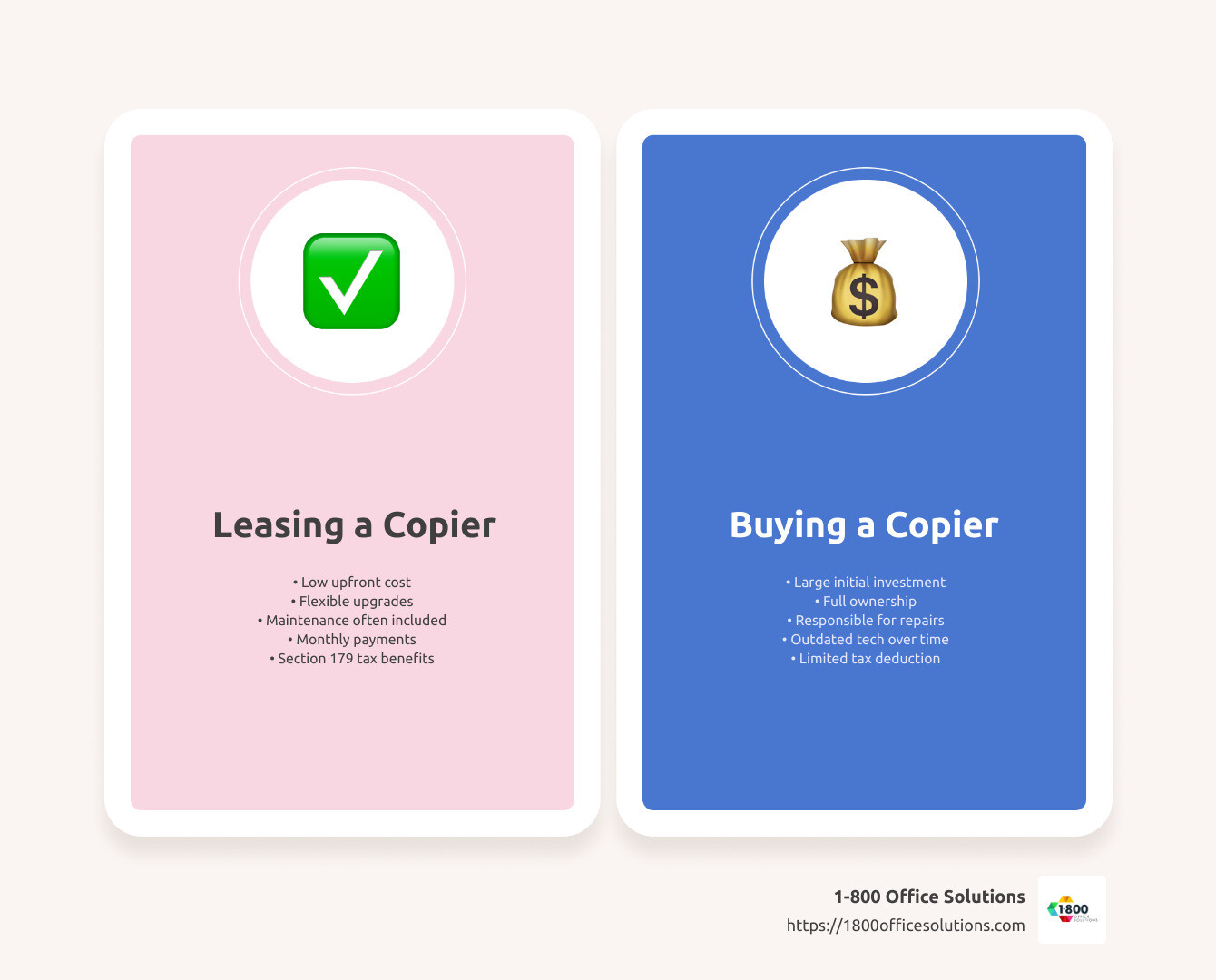

When your office printer starts making that strange grinding noise again, you know it’s time for an upgrade. But looking at those price tags can give anyone sticker shock! That’s where affordable copier leasing comes in—it’s like getting that shiny new technology without emptying your company’s wallet all at once.

Think of copier leasing as the smart middle path between buying expensive equipment outright and making do with outdated technology. Instead of watching $5,000 to $35,000 disappear from your account in one painful transaction, you can spread that cost into manageable monthly payments that won’t keep your accountant up at night.

One office manager recently told me, “Leasing has tax breaks, and is a low-interest way to get a $6,000 to $10,000 copier on site without a large upfront payment.” That’s the beauty of it—you preserve your cash flow while still giving your team the tools they need to shine.

Most businesses find sweet spots with lease terms between 12 and 60 months. The monthly investment varies based on what your office needs:

| Copier Type | Monthly Lease Cost | Best For |

|---|---|---|

| Basic Monochrome | $65-$135 | Small offices, low volume |

| Advanced Monochrome | $200-$350 | Medium businesses, high B&W volume |

| Color Multifunction | $250-$500 | Marketing teams, client materials |

| High-Volume Production | $600-$900 | Large enterprises, print shops |

What I love about affordable copier leasing is the flexibility it offers growing businesses. As your company evolves, your equipment needs change too. With leasing, you’re not stuck with yesterday’s technology—many agreements include upgrade options so you can stay current without starting from scratch.

Plus, there’s the peace of mind that comes with maintenance coverage. Imagine never again having to watch YouTube tutorials on how to fix paper jams or replace toner cartridges! Most lease agreements include service plans that keep your equipment running smoothly, with technicians just a phone call away.

For businesses trying to balance innovation with budget constraints, leasing creates breathing room. You can direct your capital toward revenue-generating activities while still enjoying modern office technology that keeps productivity humming along.

Copier Leasing 101: Key Concepts & How It Works

Stepping into copier leasing is a lot like choosing to rent your first apartment instead of diving into homeownership. You get all the perks of having great equipment at your fingertips without the wallet-emptying upfront costs or the headaches that come with owning complex machinery.

Affordable copier leasing works through a friendly three-way partnership: there’s you (looking for great office equipment), us at 1-800 Office Solutions (your equipment experts), and a finance company (the folks who actually own the machine). We provide the perfect copier and keep it running smoothly, while the finance company handles the payment side of things.

When you’re browsing lease options, you’ll run into some industry terms worth knowing:

- Lease Term: This is simply how long you’ll have the equipment—typically anywhere from 12 months for maximum flexibility to 60 months for the lowest monthly payments

- Fair Market Value (FMV) Lease: The most popular option where you return the equipment when your lease ends or buy it at whatever it’s worth then

- $1 Buyout Lease: You’ll pay a bit more each month, but when the lease ends, the copier is yours for just one dollar

- Maintenance Agreement: The peace-of-mind package that covers service, repairs, and sometimes even supplies

- Duty Cycle: How many pages your machine can comfortably handle each month without breaking a sweat

- Cost Per Page: What you’re really paying for each document you print

- Overage Charges: The extra fees if your team prints more than your monthly allowance

What Is a Copier Lease?

A copier lease is basically a promise between friends (well, business friends). You get to use a great copier or multifunction printer for a set time, and in return, you make predictable monthly payments. Unlike buying a copier outright—where you own it from day one but watch it depreciate like a new car—leasing gives you usage rights with budget-friendly payments that you can plan around.

Mario Richardson recently leased a system from us and shared: “Great company, fast response with good engineers and all at an incredibly reasonable price. The lease terms were straightforward and they handled everything from delivery to setup.”

The real beauty of leasing is how it transforms what would normally be a big capital expense (think $5,000-$35,000 upfront!) into a manageable monthly operational cost. This approach often comes with nice tax advantages and keeps your business credit lines open for other important investments.

How Does the Leasing Process Flow?

Working with us to lease your next copier is refreshingly simple:

First, we’ll chat about your needs—how many pages you print monthly, what features would make your team’s life easier, and what fits your budget. No pressure, just helpful guidance.

Next comes a quick credit application. The finance company runs a standard credit check to determine approval and your rates.

Once you’re approved (which happens for most businesses), you’ll sign a straightforward lease agreement that spells out your monthly payment, how long you’ll have the equipment, and other important details.

The exciting part comes next: delivery day! Our technicians bring your new equipment, set it up, connect it to your network, and make sure everything’s working perfectly.

We’ll then spend time training your team on all the cool features of your new system—no one likes feeling lost when trying to make double-sided copies five minutes before a meeting!

After that, you’ll receive regular monthly invoices, and our service team stays ready to help with any maintenance needs according to your agreement.

“We make it as easy as 1-2-3,” explains Davis Stratos, who recently worked with our team. “They exceeded my expectations in every way, providing exceptional customer service and cost savings.”

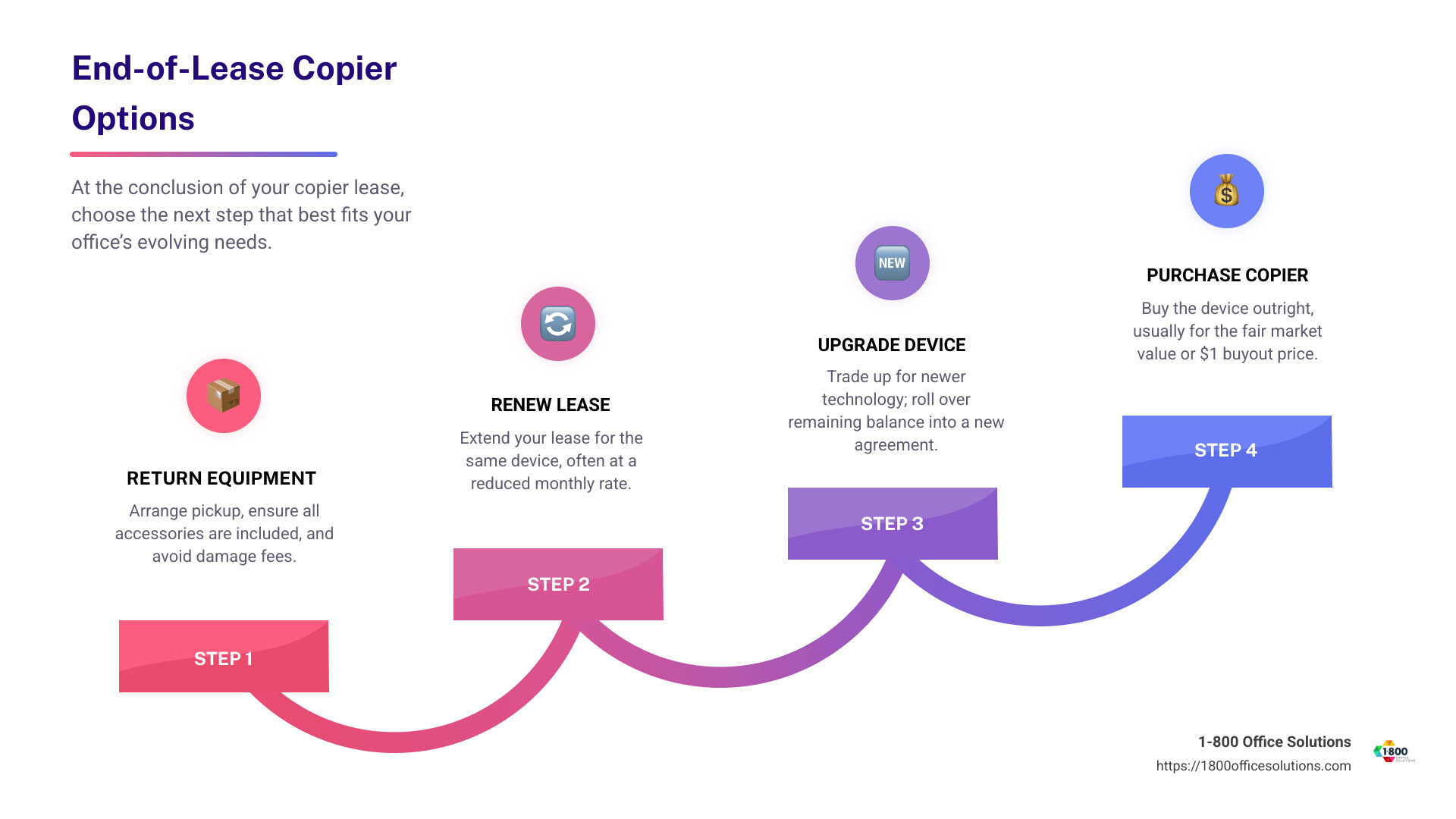

When your lease term eventually winds down, you’ll have options: renew with the same equipment if it’s still meeting your needs, upgrade to something newer with more features, return the equipment, or purchase it depending on your lease type.

With affordable copier leasing, you’re never stuck with outdated technology or unexpected repair bills. It’s the smart way for growing businesses to stay current without breaking the bank.

Affordable Copier Leasing: Cost Breakdown & Money-Saving Factors

Let’s talk money – because that’s why you’re considering affordable copier leasing in the first place, right?

When business owners ask me about leasing costs, I always say, “It depends on what you need, not what someone wants to sell you.” Monthly payments typically range from $65 to $900, but understanding what drives these costs helps you negotiate better terms.

Think of your copier lease like a smartphone plan – the fancier the device and the more data you need, the higher your monthly bill. For copiers, the main factors affecting your monthly payment are pretty straightforward. Equipment type makes the biggest difference – a basic desktop model costs far less than a production-grade machine that can print, fold, and staple at lightning speeds. Your monthly print volume matters too – higher volume needs mean more robust (and expensive) equipment.

Then there’s the color versus black-and-white decision. Color machines typically run 20-40% more expensive, but for many businesses, the ability to produce professional color materials in-house is worth every penny. The length of your lease affects monthly payments too – stretching to 60 months instead of 36 will lower your monthly bill, though you’ll pay more in the long run.

“When we switched to a 48-month lease instead of 36, our monthly payment dropped by almost $75,” shares Katie McCarty, who runs a small marketing firm. “The tax benefits alone made leasing worthwhile for our budget.”

Speaking of tax benefits – this is where leasing really shines. Under Section 179 of the IRS tax code, businesses can often deduct the full cost of leased equipment as an operating expense rather than depreciating it over time. This creates substantial tax savings, especially for small businesses watching every dollar.

Affordable copier leasing costs by copier type

Different businesses have different copying needs, and the equipment you choose dramatically impacts your monthly investment:

Basic Monochrome Copiers ($75-$135/month) are perfect for small offices with minimal printing needs. These workhorses handle 25-35 pages per minute and up to 5,000 pages monthly, with basic copying and network printing capabilities. Think of these as your reliable sedan – nothing fancy, but gets the job done efficiently.

Advanced Monochrome Copiers ($200-$350/month) step things up significantly. With speeds of 35-60 pages per minute and monthly volumes of 10,000-20,000 pages, these machines add scanning, duplexing, and finishing options. Medium-sized businesses with high black-and-white needs love these models for their reliability and advanced features.

Color Multifunction Copiers ($250-$500/month) are the Swiss Army knives of office equipment. Running at 30-45 pages per minute and handling 5,000-15,000 monthly pages, these all-in-one systems deliver color printing, scanning, faxing, and mobile printing. They’re ideal for businesses creating marketing materials or client-facing documents where professional presentation matters.

High-Volume Production Units ($600-$900/month) are the commercial-grade powerhouses. With blazing speeds of 60-100+ pages per minute and monthly volumes from 20,000 to well over 100,000 pages, these machines feature advanced finishing options, high-capacity trays, and professional print quality. In-house print shops and high-volume office environments rely on these workhorses daily.

An office manager from Cambridge told me recently: “We’re leasing a Xerox WC7335P for 5 years at $287 monthly, which includes 7,000 black and white copies and 2,000 color copies per month. They even threw in some supply perks that saved us hundreds more.”

Hidden Fees to Watch Out For

The word “hidden” says it all – these are the costs that aren’t prominently featured in sales presentations. When pursuing affordable copier leasing, keep your eyes peeled for these potential budget-busters:

Overage charges can quickly turn a good deal sour. Most leases include a set number of prints per month, and exceeding this triggers per-page fees that accumulate fast. Be realistic about your volume needs when setting up your contract.

Delivery and installation costs might not be included in the quoted lease price. These can range from $200-$500 depending on your location and the complexity of setup.

Property tax considerations vary by state – in some locations, leased equipment is subject to property tax that gets passed along to you as the lessee.

Insurance requirements often catch businesses by surprise. Your lease may require you to insure the equipment, adding another monthly expense to your total cost.

Early termination fees protect the leasing company if you break the agreement early. These penalties can be substantial – often equal to the remaining payments on your contract.

End-of-lease fees include return shipping, inspection charges, or excessive wear costs when returning equipment. These typically come due right when you’re focused on transitioning to new equipment.

Automatic renewal clauses are perhaps the sneakiest of all. Many leases automatically renew if not canceled within a specific timeframe (often 90-180 days before expiration), potentially locking you into another year or more.

A medical practice in Burbank found a creative workaround: “We leased a refurbished Ricoh MPC4502 that had been previously owned by another practice nearby. Our five-year lease includes a $1 buyout at the end, and they created a monthly payment that fits perfectly within our budget constraints.”

The key to truly affordable copier leasing isn’t just finding the lowest monthly payment – it’s understanding the complete cost picture and negotiating terms that align with your actual business needs and printing habits. At 1-800 Office Solutions, we believe transparency about these costs upfront leads to happier clients and longer relationships.

Types of Copier Lease Agreements & Choosing the Right Fit

When it comes to finding the perfect copier solution for your business, understanding the different lease types is like knowing which tool to grab from your toolbox. Let’s explore your options to help you make the best choice for your unique situation.

Fair Market Value (FMV) Lease feels like leasing a car—you’ll enjoy lower monthly payments while keeping your options open. At the end of your 24-60 month term, you can return the equipment, purchase it at its current market value, or upgrade to newer technology. This option is perfect for businesses that want to stay on the cutting edge without breaking the bank each month.

“We switched to an FMV lease last year and love the flexibility,” shares a marketing director from Tampa. “When our needs changed unexpectedly, we weren’t stuck with outdated equipment.”

$1 Buyout Lease works more like a rent-to-own plan. Your monthly payments will be higher, but there’s a sweet reward at the end—you’ll own the copier outright for just one dollar when the lease concludes. This 36-60 month option makes perfect sense if you’re planning a long-term relationship with your copier.

The Operating Lease keeps your equipment off your balance sheet, which can be a significant advantage depending on your accounting strategy. With shorter 24-36 month terms, this option appeals to companies keeping a close eye on their financial statements.

For businesses looking to build equity, a Capital Lease treats your agreement more like a purchase on your books. The 36-60 month terms provide ownership benefits while still giving you the advantage of monthly payments instead of one large purchase.

Need equipment for a specific project or timeline? Short-Term Leases offer 12-24 month commitments with higher monthly payments but far less long-term obligation. This option shines for businesses with rapidly changing needs or specific project-based requirements.

Budget-conscious? Consider a Refurbished Equipment Lease. These previously-used, professionally refurbished copiers come with significantly reduced rates over 24-36 month terms—perfect for small businesses watching every penny.

An IT manager from Illinois took a different approach: “After comparing multiple lease options, we actually decided to purchase a Toshiba 4500 Series outright for $11,000. The comprehensive maintenance policy covering toner, ink, and supplies made more sense for our particular usage patterns.”

You can learn more about the ins and outs of these different agreements at our copier lease agreements guide.

Affordable copier leasing checklist for agreement selection

Finding the right affordable copier leasing agreement doesn’t have to feel overwhelming. I’ve created this practical checklist to help you evaluate your options:

Match your expected print volume to the machine’s duty cycle, aiming for at least 20% extra capacity to prevent overworking your equipment. Understand your end-of-term options clearly—whether you can return, buy, renew, or upgrade. Confirm the service level agreement details, especially response times for repairs when you’re in a printing emergency.

Verify if and how you can upgrade mid-lease when your business grows. Consider separating your equipment lease from service/supplies billing for greater flexibility. Know your cancellation terms and penalties before signing anything.

Pay special attention to automatic renewal clauses—these can sneak up on you if you miss the notification window. Clarify exactly what’s included in your monthly payment versus what might cost extra. Understand the expected condition for equipment returns to avoid surprise fees. And finally, confirm your payment schedule, including due dates and accepted payment methods.

“The checklist saved us from a costly mistake,” explains a dental office manager from Miami. “We almost missed the clause about automatic renewal that would have locked us in for another year.”

Can Businesses With Bad Credit Qualify?

Yes! Even if your business credit history looks more like a rollercoaster than a smooth highway, you can still qualify for affordable copier leasing. We believe every business deserves access to quality equipment.

Some providers offer no-credit-needed programs that focus on your time in business and bank account standing rather than traditional credit scores. Providing a larger security deposit—typically 1-3 months of payments—can also help offset perceived credit risk and improve your approval odds.

Having a business partner or owner with stronger credit co-sign the lease can open doors that might otherwise remain closed. Some lessors may secure the lease against other business assets you already own.

Programs like those offered by Acima provide lease-to-own options with more flexible credit requirements. And sometimes, simply agreeing to a shorter lease term can reduce the lessor’s risk enough to approve your application.

“I was worried our startup wouldn’t qualify because we had no credit history,” confides a small business owner from Detroit. “But 1-800 Office Solutions found us a finance partner willing to work with our situation, and now we have a professional-grade copier that’s helped us land bigger clients.”

At 1-800 Office Solutions, we work with multiple finance partners specifically to find solutions that fit your unique situation—because we understand that credit challenges shouldn’t prevent you from having the tools you need to succeed.

How to Secure the Best Deal and Avoid Pitfalls

Let’s face it—negotiating a copier lease can feel a bit like buying a car. There’s the sticker price, then there’s what you actually should pay. When it comes to affordable copier leasing, a little preparation goes a long way in saving your business thousands over the life of your lease.

The smartest approach? Always get multiple quotes. I recently worked with a dental office that saved nearly 25% simply by showing their preferred vendor what two competitors had offered. As their office manager told me, “It was like magic—suddenly there was room to negotiate when we had other options on the table.”

One strategy that consistently saves our clients money is separating the equipment lease from the service agreement. Think of it like buying a car and its maintenance plan separately. This gives you the flexibility to keep the equipment if service disappoints, or switch equipment while maintaining a good service relationship.

When comparing quotes, look beyond the monthly payment. A $50 difference might seem small, but multiplied across a 60-month lease, that’s $3,000! Factor in potential overage charges, delivery fees, and those sneaky end-of-lease costs that can surprise you when the contract ends.

Many business owners find the “cost per page” metric more useful than focusing solely on the monthly lease payment—especially if your print volume varies month to month. A slightly higher monthly payment with a lower cost per page often saves money for businesses with higher print volumes.

“I wish someone had told me to read the fine print,” shared one business owner who got stuck in an automatic renewal. “We ended up paying for an extra year because we missed the 90-day cancellation window.” Always review those automatic renewal clauses, early termination fees, and end-of-lease requirements before signing.

Negotiation Hacks for Affordable Copier Leasing

The difference between a good deal and a great deal often comes down to timing and knowledge. Affordable copier leasing becomes even more affordable when you know how to negotiate effectively.

Benchmark rates before any discussion. Knowledge is power, and understanding current market rates for similar equipment gives you solid ground to stand on during negotiations. Websites and forums where businesses share their lease terms can be goldmines of information.

Consider flexible term lengths rather than standard ones. A 39-month lease might offer better rates than the typical 36-month term simply because it’s less common. One law firm I worked with saved 8% just by extending their lease by three months.

Timing matters more than you might think. Dealers and finance companies typically have end-of-quarter quotas to meet, making them more flexible in March, June, September, and December. One client called in the last week of December and secured a deal that had been “impossible” just weeks earlier.

If you’re leasing multiple machines, always ask for a bundle discount. Volume discounting is standard practice, but you won’t get it if you don’t ask. Similarly, some lessors offer discounts for pre-paying several months upfront.

Don’t forget to negotiate service response guarantees with specific response time commitments. A cheaper lease means nothing if your team is left waiting days for repairs. And consider adding technology refresh clauses that allow mid-lease upgrades if your business needs change.

Finally, never hesitate to ask a preferred vendor to match competitive quotes. Most will happily do so rather than lose your business entirely.

Common Pitfalls to Avoid

Even the most careful business owners can get caught by these common leasing traps. Here’s how to avoid them:

Automatic renewal traps are perhaps the most notorious. Many leases automatically renew for 12 months if not canceled 90-180 days before expiration. One small business owner shared, “I literally set three calendar reminders—one at 180 days, one at 120, and one at 90 days before our lease ended. I wasn’t taking any chances!”

Watch out for minimum click charges that bill you for a minimum number of prints monthly, even if your actual usage is lower. This is especially problematic for seasonal businesses or those with fluctuating print needs.

Some contracts include escalating payments that increase over the lease term. What starts as an affordable monthly payment might not stay that way. Always calculate the total lease cost, not just the initial payment.

Be realistic about your print volume. Overestimating your needs leads to paying for capacity you’ll never use. One school administrator told me, “We based our volume on peak months and ended up with a machine that was twice what we needed for most of the year.”

While convenient, all-inclusive bundling of equipment and service can obscure actual costs and make it difficult to change service providers if problems arise. The transparency of separate agreements often outweighs the convenience of bundling.

Many lessees are surprised by end-of-term freight costs when returning equipment, which can run $300-$500. Ask about these costs upfront and negotiate who covers them.

Ensure service agreements specify response times and coverage details. Vague terms like “reasonable response time” leave too much room for interpretation when you’re dealing with a deadline and a machine that won’t cooperate.

Finally, check for excessive insurance requirements. Some leases require comprehensive insurance with coverage limits that exceed the equipment’s value. You might already have coverage under your business policy, so avoid paying twice.

For more detailed information about navigating copier lease agreements, check out our comprehensive guide at More info about copier lease agreements and More info about copier leasing tips.

At 1-800 Office Solutions, we’ve helped thousands of businesses across the country secure fair, transparent lease terms that protect their interests while providing the equipment they need. As one client put it, “They explained everything in plain English—no industry jargon or hidden surprises. Just straight talk about what would work best for our budget.”

Managing Your Lease: Upgrades, Maintenance & End-of-Term Options

Getting the most from your affordable copier leasing agreement doesn’t end after signing the contract. Smart management throughout the lease term can save you money, prevent headaches, and ensure your equipment continues meeting your needs as your business evolves.

Maintenance & Supplies Inclusion

The days of panicking when your copier breaks down are over when you have a comprehensive maintenance agreement. Most modern leases include service packages that take the worry out of equipment ownership.

“Last Tuesday our main office copier jammed during a big proposal preparation, and I was amazed when the technician arrived within two hours,” shares Melissa, an office administrator from Tampa. “Everything was covered under our agreement—no surprise bills or lengthy downtime.”

A good maintenance agreement typically covers parts and labor for repairs, ensuring you’re not hit with unexpected costs when something goes wrong. Many packages also include preventive maintenance visits, where technicians clean, adjust, and inspect your equipment before problems develop.

One of the biggest advantages is toner and supplies inclusion. Rather than tracking inventory and ordering cartridges, many agreements automatically ship supplies before you run out. This “just in time” approach means you’ll never face that dreaded “toner low” message during an important print job.

For businesses that can’t afford downtime, look for agreements with specific response time guarantees. These typically range from 4 hours to next business day, depending on your service level.

Technology has improved service delivery too, with remote monitoring systems that alert technicians to potential issues before they cause failures. Many problems can even be resolved through help desk support without requiring an on-site visit.

To get maximum value from your maintenance agreement:

Track your actual usage against your contracted volume to avoid overpaying. Train your team on proper machine operation to prevent unnecessary service calls. And always report even minor issues promptly—that strange noise today could become a major breakdown tomorrow if left unchecked.

Smooth Upgrades During the Lease

Business needs rarely remain static for 3-5 years, which is why flexible technology refresh options are valuable in any leasing agreement.

James, a small business owner in Grand Rapids, explains how this worked for his company: “We started with a basic model, but as our client base grew, we needed faster printing and color capabilities. Our lease had a technology refresh clause that let us upgrade in month 30 without penalty. The remaining payments just rolled into our new agreement.”

When considering a mid-lease upgrade, start by assessing your changing needs. Has your monthly print volume increased significantly? Do you need new features like stapling or booklet creation? Are color prints now essential for your marketing materials?

Most lessors allow for applying lease balance from your current agreement toward a new one. This process, sometimes called a “lease buyout,” lets you upgrade without paying off the old lease separately. The remaining balance simply becomes part of your new lease calculation.

An upgrade opportunity also presents a perfect time for negotiating new terms. You might be able to secure better rates, improved service response times, or more flexible volume allowances based on your payment history and increased equipment value.

One important caution: watch out for restart pitfalls when upgrading. Some less scrupulous providers might try to extend your overall leasing period significantly. For example, if you’re 36 months into a 60-month lease and upgrade, make sure you’re not automatically committed to another full 60 months unless that works for your business plan.

When your lease approaches its end date, you’ll typically face four choices:

- Return the equipment and end the relationship

- Renew the lease at a reduced rate (often 15-20% lower)

- Upgrade to new equipment on a fresh lease

- Purchase the equipment at either fair market value or a predetermined amount

Making this decision shouldn’t be a last-minute scramble. Start evaluating your options about 6 months before lease end to give yourself time to assess your needs, budget, and the current technology landscape without pressure.

“We almost got caught by automatic renewal,” admits Carlos, an accounting firm manager from Philadelphia. “Thankfully, we checked our contract and realized we needed to give 90 days’ notice to avoid renewal. We marked our calendar and made a deliberate choice instead of defaulting into another year with outdated equipment.”

At 1-800 Office Solutions, we help clients steer these end-of-term decisions with clear explanations and no pressure tactics. After all, a successful long-term relationship benefits both of us more than a one-time transaction.

For more information about the advantages of leasing equipment for your business, check out our detailed guide on leasing advantages.

Frequently Asked Questions about Affordable Copier Leasing

If you’re still weighing your options about copier leasing, you probably have some questions. Let’s tackle the most common ones I hear from businesses just like yours.

How much does an average lease cost per month?

When it comes to affordable copier leasing, there’s quite a range depending on what you need. Most businesses pay between $65 and $900 monthly, with the sweet spot for small to medium businesses typically falling between $200-$400 for a decent color multifunction machine.

Your monthly payment isn’t pulled from thin air – it’s calculated based on several factors that matter to your business. The equipment model and features play a big role (naturally, that fancy finisher with stapling costs more than a basic model). Print speed and volume capacity also factor in, as faster machines with higher duty cycles command premium prices.

The length of your lease affects your payment too – opting for 36 months instead of 60 will increase your monthly bill but reduce your total commitment. Your business credit rating matters as well, and don’t forget to consider what maintenance and supplies are included in your package.

I recently spoke with an IT manager from Detroit who shared: “We found that leasing our Canon ImageRunner for $287 monthly was more cost-effective than purchasing when we factored in maintenance and the ability to upgrade in three years.” This perfectly illustrates the value proposition many businesses find with leasing.

What happens if my print volume changes mid-term?

Business needs rarely stay static for years at a time, and most leasing companies understand this reality. If your print volume suddenly increases – perhaps you’ve landed a big client or expanded your marketing efforts – you have options:

You can simply pay the overage charges, which typically run about 1-3 cents per black page and 7-15 cents per color page. If the increase seems permanent, you might be better off renegotiating your contract for a higher monthly allowance. Some businesses even use this opportunity to upgrade to a higher-capacity machine mid-lease.

On the flip side, if your volume drops significantly (as happened to many during the pandemic), you’re not completely stuck. Some lessors will allow you to downgrade your volume commitment for a modest fee. You might also transfer the lease to a different department with higher needs, or consider consolidating multiple machines.

A law firm in Philadelphia shared a relevant experience: “When COVID hit and our office went hybrid, our print volume dropped by 60%. Our leasing company worked with us to adjust our monthly minimum clicks, saving us nearly $200 monthly.” This flexibility is one of the hidden benefits of working with the right leasing partner.

Are copier lease payments 100% tax-deductible?

Here’s some good news for your accounting department: in most cases, affordable copier leasing payments are fully tax-deductible as business operating expenses in the year they’re paid. This represents a significant advantage over purchasing equipment outright.

When you buy a copier, you typically need to capitalize the asset and depreciate it over several years (usually 5-7 years for office equipment). With leasing, however, the full monthly payment amount can usually be deducted immediately as an operating expense, improving your short-term cash flow and tax situation.

It gets even better. Section 179 of the IRS tax code may allow you to deduct the full cost of leased equipment in the first year of the lease, depending on the lease structure and current tax regulations. This provision can create substantial tax savings, especially for small businesses.

That said, tax laws are complex and constantly evolving. I always recommend chatting with your accountant or tax professional before making decisions based on tax implications. They can provide guidance specific to your business situation and ensure you’re maximizing available deductions while staying compliant.

Conclusion

Affordable copier leasing

truly opens doors for businesses that want modern office technology without emptying their bank accounts. Throughout this guide, we’ve seen how leasing creates a win-win situation for companies of all sizes – from the neighborhood print shop to growing enterprises with multiple locations.

Think about what matters most to your business right now. Is it preserving your capital for other investments? Creating predictable monthly expenses you can actually budget for? Or perhaps you’re tired of being stuck with outdated equipment while your competitors zoom ahead with the latest features?

Leasing solves these challenges beautifully. You get cutting-edge technology today while spreading payments over time. Many of our clients tell us how relieved they are to have maintenance and support included, eliminating those surprise repair bills that used to derail their budgets.

“The flexibility to upgrade was what sold me,” explains Maria, a marketing director from Tampa. “Our company is growing fast, and with leasing, we’re never stuck with yesterday’s technology.”

At 1-800 Office Solutions, we’ve walked thousands of businesses across the country through the leasing process. Our nationwide team understands that what works for a startup in Miami might be completely different from what an established business in Chicago needs. We take pride in matching each client with the perfect equipment and terms for their unique situation.

The best part? The potential tax advantages can make leasing even more attractive than you initially thought. Many of our clients appreciate being able to deduct their lease payments as business expenses rather than dealing with depreciation schedules.

Whether you’re in Orlando looking for your first office copier, a Philadelphia law firm needing high-volume production equipment, or an Atlanta healthcare provider requiring secure document solutions – we’ve got you covered. Our team serves businesses across all 50 states with the personalized attention you deserve.

Finding the right balance between your current budget and future needs is what we do best. We’ll help you steer lease types, negotiate favorable terms, and manage your agreement throughout its lifecycle. The result? All the benefits of modern office technology with costs that make your accountant smile.

Ready to explore how affordable copier leasing can work for your specific business? Contact 1-800 Office Solutions today for a free, no-pressure quote custom to your requirements. Our friendly experts will guide you through the options, ensuring you get the right equipment at the right price with terms that actually make sense for your budget.

Thousands of businesses nationwide have already funded the leasing advantage with us. Isn’t it time you did too?