Cheat Sheet to Copier Lease Comparison

A copier lease can transform how your business manages office equipment costs and technology upgrades. Instead of paying thousands upfront for a copier that might become outdated in a few years, leasing lets you access the latest technology with predictable monthly payments.

Quick Copier Lease Benefits:

- Lower upfront costs – Avoid large capital expenses

- Predictable monthly payments – Easier budgeting and cash flow management

- Tax advantages – Lease payments are typically tax-deductible as operating expenses

- Access to latest technology – Upgrade to newer models without selling old equipment

- Included maintenance – Service, repairs, and supplies often bundled in

- Flexible terms – Choose 36, 48, or 60-month agreements based on your needs

The managed print services market is projected to reach $59.8 billion by 2027, and businesses that lease copiers can save up to 30% compared to purchasing outright. These savings come from avoiding large upfront costs, predictable maintenance expenses, and the ability to upgrade technology regularly.

As one copier sales manager noted: “Let’s say your operations team just signed a new copier lease agreement. The price looks great, the device is sleek—but three weeks in, you realize it’s missing features your team uses every day.” This highlights why understanding your lease options matters.

Whether you’re dealing with an aging copier that breaks down constantly or need to upgrade your office’s printing capabilities, a well-structured lease agreement can provide the technology you need while preserving your capital for core business activities.

Copier lease terms you need:

Unpacking the Benefits of an Office Copier Lease

When you’re considering a copier lease, you’re really looking at a strategic business decision that can transform how your company manages both finances and daily operations. Think of it as choosing a partner rather than just acquiring equipment – one that grows with your business and supports your success every step of the way.

The financial benefits alone make leasing compelling, but the operational advantages – from automatic maintenance to seamless technology upgrades – create a comprehensive solution that lets you focus on what matters most: running your business. Let’s explore how a copier lease can work for you.

For businesses looking to optimize their entire technology infrastructure, check out our IT services to see how we can support your broader operational needs.

Lower Upfront Costs and Predictable Expenses

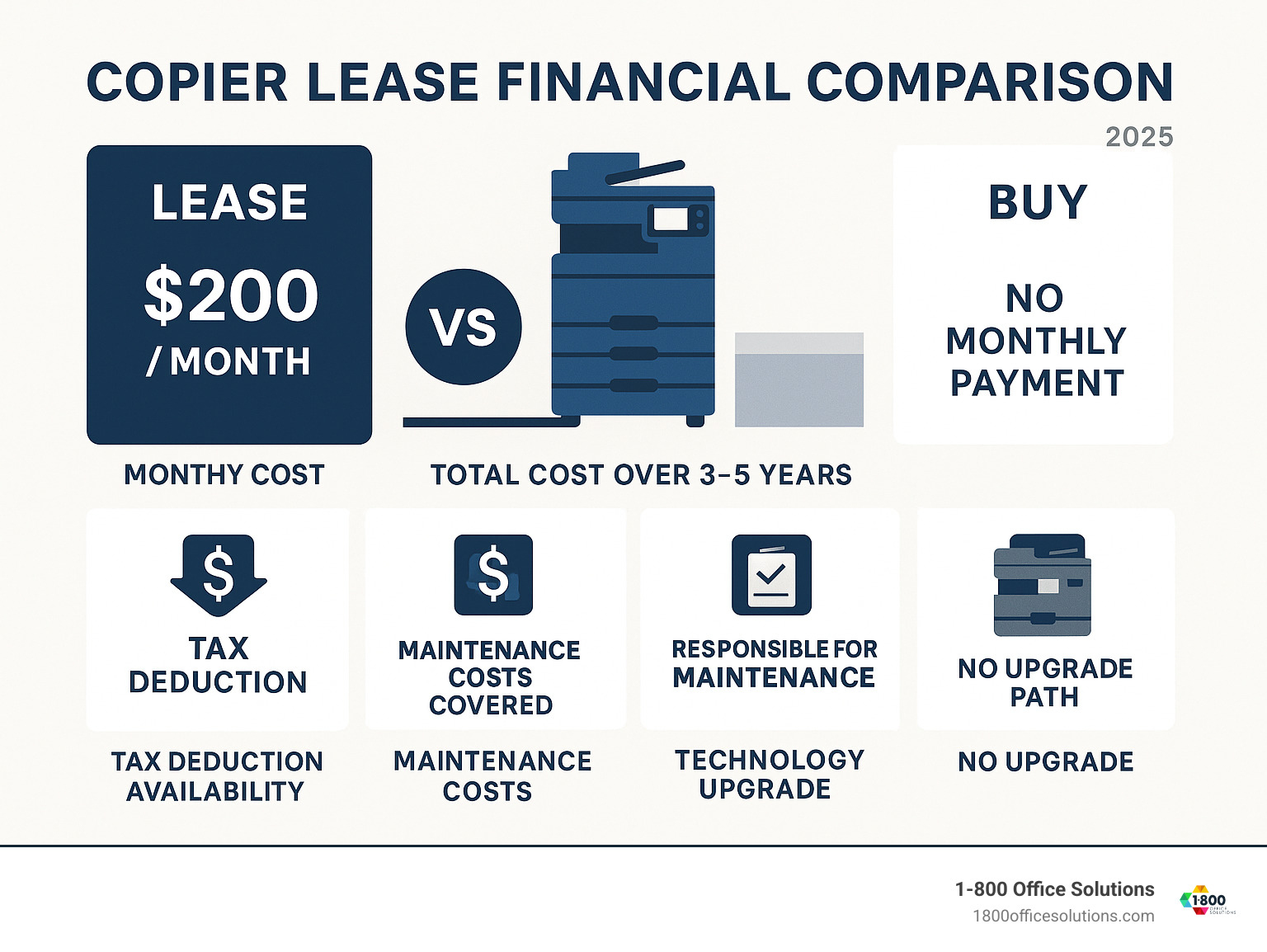

Here’s where a copier lease really shines – capital preservation. Instead of writing a check for $5,000 to $15,000 upfront, you can get that same high-quality equipment with manageable monthly payments that fit comfortably into your budget.

This approach frees up significant cash that you can invest in growth opportunities. Maybe it’s hiring that new sales rep you’ve been considering, launching a marketing campaign, or building up your emergency fund. The flexibility is yours.

Fixed monthly payments make budgeting incredibly straightforward. No surprise repair bills showing up at the worst possible moment. No wondering how much that maintenance call will cost. Everything is predictable, which means you can plan ahead with confidence.

Our research consistently shows that businesses save up to 30% compared to purchasing outright when they choose leasing. These savings come from avoiding large upfront costs, predictable maintenance expenses, and the ability to upgrade without selling old equipment.

Tax Advantages of Leasing

Let’s talk about something that makes your accountant smile – the tax benefits of a copier lease. Most lease payments qualify as operating expenses, which means they’re typically fully tax-deductible. This reduces your taxable income and puts money back in your pocket.

Some businesses can even take advantage of the Section 179 deduction, allowing you to deduct the full value of qualifying equipment. It’s like getting help from the government to fund the equipment your business needs.

The key is working with your tax professional to understand exactly how leasing impacts your specific situation. Every business is different, and proper financial planning ensures you maximize these advantages while staying compliant with IRS guidelines.

Staying Current with Technology

Nobody wants to be stuck with yesterday’s technology, especially when your competitors are using the latest and greatest. A copier lease solves this challenge beautifully by giving you easy upgrade paths every 3 to 5 years.

This means you’re never dealing with obsolete equipment that slows down your team or lacks the features modern businesses need. Today’s copiers offer incredible advances – faster printing, crystal-clear scanning, mobile connectivity, and sophisticated finishing options that make your documents look professional.

Improved security features are particularly important in today’s business environment. Newer models include data encryption, secure print release, and advanced access controls that protect sensitive information. These aren’t just nice-to-have features – they’re essential for maintaining client trust and regulatory compliance.

For comprehensive protection of your business data and systems, explore our cybersecurity services to see how we can safeguard your entire operation.

Hassle-Free Maintenance and Support

Perhaps the most stress-relieving aspect of a copier lease is knowing that maintenance and support are handled for you. When you own equipment, every repair, every replacement part, every service call comes out of your pocket – often at the most inconvenient times.

With leasing, included service means expert technicians are just a phone call away. Reduced downtime keeps your business running smoothly because problems get resolved quickly by people who know your equipment inside and out.

Many programs include automatic supply fulfillment, so toner, drums, and other consumables arrive before you run out. No more emergency runs to the office supply store or dealing with poor-quality generic supplies that can damage your equipment.

This comprehensive approach to managed print services typically reduces printing costs by 20% while improving reliability and performance. You get professional-grade support without the headaches of managing it yourself.

To learn more about optimizing your entire printing operation, visit our managed print services page for detailed information about how we can streamline your document workflow.

Understanding the different types of copier lease options and associated costs is crucial to making an informed decision. Not all leases are created equal, and choosing the right one for your business can save you time, money, and headaches down the road.

Fair Market Value (FMV) vs. $1 Buyout Leases

When you’re ready to sign a copier lease, you’ll encounter two main types that work very differently. Think of it like choosing between renting an apartment or taking out a mortgage – each serves different business goals.

Fair Market Value leases are the most popular choice, especially for 36-month terms. With an FMV lease, your monthly payments stay lower because you’re paying for the privilege of using the equipment, not owning it. At the end of your lease, you have three straightforward options: return the copier to the leasing company, renew your lease (often at a reduced rate), or purchase the equipment at whatever its fair market value happens to be at that time.

$1 Buyout leases work more like a loan with a guaranteed happy ending. Yes, your monthly payments will be higher, but here’s the payoff: when your lease term ends, you own that copier for just one dollar. This option makes perfect sense if you plan to keep the equipment for many years and prefer the security of ownership.

The key differences come down to monthly payment amounts, ownership rights, and accounting treatment. FMV leases typically offer lower monthly payments and easier technology upgrades, while $1 buyout leases provide guaranteed ownership and may offer different tax advantages through depreciation deductions.

| Feature | Fair Market Value (FMV) Lease | $1 Buyout Lease (Capital Lease) |

|---|---|---|

| Ownership | No ownership during or at end of term | Ownership at end of term for $1 |

| Monthly Payment | Typically lower | Typically higher |

| End-of-Term | Return, renew, or purchase at FMV | Own for $1 |

| Accounting | Off-balance sheet (operating expense) | On-balance sheet (asset and liability) |

| Tax Treatment | Payments generally fully tax-deductible | Depreciation deductible, interest portion deductible |

| Flexibility | Easier to upgrade to new technology | Less flexible for frequent upgrades |

New, Demo, and Repossessed Copiers: What’s the Difference?

Your copier lease options extend beyond just the lease structure – you also get to choose the condition of your equipment. Each option offers distinct advantages depending on your priorities and budget.

New equipment gives you that fresh-out-of-the-box experience with the latest technology, full manufacturer warranties, and pristine condition. If having cutting-edge features and maximum reliability tops your priority list, new is the way to go. Your monthly lease payments will reflect this premium choice, but you get complete peace of mind.

Demo units represent one of the best-kept secrets in copier leasing. These machines have lived pampered lives as showroom models or trade show demonstrations, often with incredibly low page counts – sometimes as few as 37 pages! You can save thousands of dollars compared to new equipment while getting essentially brand-new performance and modern features. It’s like buying a car with only test-drive miles on it.

Repossessed copiers offer the most substantial cost savings for budget-conscious businesses. These machines come from previous leaseholders who returned them due to business changes or upgrades. Before you worry about quality, know that reputable leasing companies thoroughly inspect, service, and certify these machines to ensure reliable performance. They’re perfect for businesses that need dependable equipment without the premium price tag.

We offer a comprehensive range of options to match every business need and budget. Explore our commercial copier options to find your perfect match.

Understanding the Costs of a Copier Lease

The cost of your copier lease depends on several factors, but most businesses pay between $50 and $300 monthly for basic to mid-range machines. More advanced multifunction devices can range from $100 to $650 per month, though some basic models start as low as $49 monthly.

Your monthly payment typically includes two components. The base equipment payment covers the copier itself – this stays the same every month. The variable costs depend on how much you actually print. Most leases include a base print allowance, and if you exceed that, you’ll pay additional per-page charges.

Understanding these overage rates is crucial because they can dramatically impact your total costs. Laser devices typically cost about 6-9 cents per color page and 1 cent or less for black and white, while inkjet devices can run much higher at 20-32 cents for color and 9 cents for black and white.

Watch out for potential surprise costs that can catch you off guard. Annual price increases of 5-10% sometimes hide in contracts, and you’ll want to negotiate these out upfront. Some agreements exclude consumables like staples, drums, and waste toner containers, making them extra expenses. Early termination fees can cost thousands if you need to end your lease early, and return fees for pickup and de-installation can add unwanted charges at the end of your term.

The key to a successful copier lease is understanding every potential charge before you sign. When you know what you’re getting into, you can budget accurately and avoid unpleasant surprises down the road.

How to Choose the Right Copier and Lease Agreement

Choosing the perfect copier lease isn’t just about finding the lowest monthly payment—it’s about matching the right equipment and terms to your business’s unique needs while planning for future growth. Think of it as finding the perfect fit for your office family.

Assessing Your Business’s Printing Needs

Before we even start talking lease terms, we need to understand exactly what your business requires from a copier. This isn’t just about getting a machine that works—it’s about getting one that works perfectly for your specific situation.

Print volume is your starting point. How many pages does your team actually print and copy each month? If you’re handling around 3,000 to 5,000 monthly pages (both color and black-and-white), a machine that prints 20 to 30 pages per minute will serve you well. But if you’re running a busy law firm or high-volume operation, you’ll want to look at faster machines—anywhere from 40 PPM up to 70 PPM. Getting this number right is critically important, and it helps us guide you toward the best copier for your needs.

The color versus monochrome decision impacts more than just the initial cost. While the equipment price difference might not be dramatic, the supplies and service costs for color copiers are generally higher. If your business relies on marketing materials, presentations, or client-facing documents, color capability is worth the investment.

Paper handling requirements matter more than you might think. Do you regularly print on legal-size paper? Need tabloid (11×17) for charts or blueprints? Use specialty paper stocks for proposals? Making sure your chosen copier handles all your paper sizes and weights prevents frustrating limitations down the road.

Finally, consider finishing features that can streamline your document production. Automatic stapling, hole-punching, and folding capabilities might seem like luxuries, but they can save significant time and create more professional-looking documents. These features often pay for themselves in improved efficiency.

Decoding the Copier Lease Agreement

Your copier lease agreement is more than just paperwork—it’s the foundation of your business relationship with the equipment and service provider. A lease is a contractual arrangement where you pay for the use of an asset, and understanding the key components protects your business interests.

Lease term length typically ranges from 12 to 64 months, with 36 and 60-month terms being most popular. Shorter leases mean higher monthly payments but give you more flexibility to upgrade technology. Longer terms reduce monthly costs but commit you to older equipment for extended periods.

Your payment schedule should clearly outline both fixed monthly payments and any variable costs like overage charges. Make sure you understand exactly when these payments are due and what happens if your usage exceeds the base allowance.

End-of-lease options vary significantly depending on whether you choose an FMV lease or $1 Buyout lease. With FMV leases, you can return the equipment, renew at reduced rates, or purchase at fair market value. $1 Buyout leases let you own the copier for just one dollar at term end.

Pay special attention to automatic renewal clauses—these can be tricky. Many leases automatically renew for another 12 months if you don’t provide written termination notice within a specific window, usually 60 to 120 days before the lease ends. Missing this deadline can lock you into another year of payments you didn’t plan for.

Early termination fees can be substantial if you need to break the lease before its natural end. Understanding these penalties upfront helps you make informed decisions about lease length and terms.

Watch out for old debt rollover tactics where providers offer seemingly lower payments by rolling remaining payments from an old lease into a new agreement. While the monthly payment looks attractive, you end up paying significantly more overall. Our advice is always to finish your current lease term cleanly.

The Power of an All-Inclusive Maintenance Program

An all-inclusive maintenance program bundled with your copier lease transforms unpredictable equipment costs into manageable monthly expenses. These comprehensive programs typically cover toner and supplies with automatic delivery, parts and labor for all repairs, and preventative maintenance to keep your copier running smoothly.

This coverage means virtually no surprise expenses related to your copier’s upkeep. Instead of worrying about repair bills or running out of toner at critical moments, you get predictable monthly payments that make budgeting much simpler. Expert technicians handle any issues promptly, reducing downtime and keeping your business running smoothly.

Managed print services often integrate with these maintenance programs, providing automated usage monitoring, device health alerts, and cost control features. Businesses using these comprehensive programs typically reduce their printing costs by an average of 20% compared to managing everything separately.

However, some experts suggest keeping your service agreement separate from the lease payment itself. Why? If your actual page volume differs significantly from estimates, you might overpay or underuse a bundled service plan. A separate maintenance agreement allows more flexibility to adjust based on changing business needs.

The good news is that you don’t need to lease equipment to get excellent service coverage. Service agreements work just as well with direct equipment purchases. We help you explore the best structure for your unique situation, ensuring you get maximum value whether you lease or buy.

Conclusion: Partnering for Your Office’s Success

When you’re evaluating a copier lease, you’re really making a decision about your business’s future. It’s about choosing a path that keeps your cash flow healthy, your technology current, and your team productive. Throughout this guide, we’ve explored how leasing delivers lower upfront costs while giving you predictable monthly expenses that make budgeting a breeze.

The benefits extend far beyond just saving money upfront. With a copier lease, you’re getting significant tax advantages since those monthly payments are typically fully tax-deductible as operating expenses. You’re staying ahead of the technology curve with easy upgrade paths that prevent your equipment from becoming obsolete. And perhaps most importantly, you’re getting hassle-free maintenance and support that keeps your business running smoothly.

We’ve also walked through the different lease types—from Fair Market Value leases that offer lower monthly payments to $1 Buyout leases that give you ownership at the end. Whether you choose new equipment, a demo unit, or a cost-effective repossessed machine, the key is finding the right fit for your specific needs and budget.

At 1-800 Office Solutions, we understand that every business is unique. That’s why we take the time to assess your printing volume, color requirements, and finishing needs before recommending a solution. We’re not just another vendor trying to push equipment—we’re your partners in finding the copier lease agreement that truly works for your business.

As a nationwide leader in office technology, we’ve helped countless small and mid-sized businesses across Florida, Michigan, Georgia, North Carolina, Pennsylvania, New York, and beyond. Our expertise goes beyond just copiers and printers; we offer comprehensive solutions including managed IT services, cybersecurity, and office supply fulfillment.

What sets us apart is our commitment to transparency and education. We want you to understand exactly what you’re signing, from those automatic renewal clauses to potential overage charges. Our goal is to help you avoid the common pitfalls that can turn a great deal into a costly mistake.

Ready to experience the difference that the right copier lease can make for your business? Get your custom copier lease quote today and let’s start building a partnership that supports your office’s success for years to come.

Can I upgrade my copier during the lease term?

Absolutely! One of the beautiful aspects of a copier lease is the flexibility it offers for upgrades. Life happens, businesses grow, and technology needs change faster than we sometimes anticipate. If you find yourself needing more advanced features or higher capacity mid-lease, we can often work out a mid-lease upgrade or technology refresh that gets you the equipment you actually need.

The process typically involves starting a new lease agreement for the upgraded equipment. However, here's where you need to be a bit careful. Some vendors might offer to "roll over" your remaining payments from the old lease into the new one, making it sound like you're getting a great deal with lower monthly payments. While this might look attractive on paper, you're essentially paying for two machines at once, which extends your overall payment period and usually increases your total cost.

Our recommendation? If possible, try to finish your current lease term before upgrading. If you absolutely need to upgrade early, make sure any arrangement is structured transparently. Coterminous add-ons that align with your existing lease end date can be a smart way to handle additional equipment without complicating your payment schedule.

Are copier lease payments tax-deductible?

This is one of those questions that makes business owners smile, and for good reason! Yes, copier lease payments are typically considered operating expenses for your business, which means they're generally fully tax-deductible. This can significantly reduce your company's taxable income, putting more money back in your pocket come tax season.

The specific tax treatment can vary depending on whether you have an operating lease versus a capital lease, and every business situation is unique. We always recommend consulting with a qualified tax professional who understands your company's financial picture. They can help you understand the precise tax implications and ensure you're maximizing any potential deductions. After all, every dollar saved on taxes is a dollar that can go back into growing your business.

What happens at the end of a copier lease?

As your copier lease nears its end, you'll want to start thinking about your next steps well in advance. Most leasing companies will reach out 60 to 90 days before your lease expires, but don't wait for them to call you. Being proactive here is key, especially since many leases include automatic renewal clauses that can lock you into another term if you don't provide proper notice.

We strongly recommend sending a Letter of Intent (LOI) to your leasing company 90 to 120 days before your lease expires. This formal communication lets them know your intentions and helps you avoid any unwanted automatic renewals.

When the time comes, you'll typically have several options to choose from. You can return the equipment to the leasing company, though be sure to understand any return fees for things like shipping or de-installation that might be outlined in your agreement. If you've grown attached to your copier and it's still meeting your needs perfectly, you can purchase it - either at fair market value if you have an FMV lease, or for just $1 if you have a $1 Buyout lease.

Many businesses choose to upgrade to a new model at this point, transitioning to the latest technology under a fresh lease agreement. This keeps you current with the newest features and security updates. Finally, if you need a little more time to decide or aren't quite ready for a new commitment, you might be able to arrange a lease extension, sometimes at a reduced monthly rate.

The key is planning ahead and understanding your options so you can make the choice that best serves your business's evolving needs.